Compliance is like brushing your teeth — it’s necessary, but it doesn’t move the needle.

Compliance is like brushing your teeth — it’s necessary, but it doesn’t move the needle. The firms that are actually making advisory work aren’t trying to do it all. They’ve found a better way, aligning three core levers that unlock serious advisory capacity: Technology. Process. Talent.

Pillar One: Technology - Not the Answer, But the Accelerator

- Cloud-based accounting software? Check.

- Workflow tools? Probably.

- Dashboards, portals, maybe even some AI-powered prep tools? It’s all there.

The firms that are actually scaling advisory don’t have more tools. They have more alignment – between systems, people, and delivery.

What That Looks Like Inside a Firm

Let’s say a client’s income spikes mid-year, maybe from a bonus, liquidity event, or unexpected gain.

In a connected system, that activity automatically triggers an internal alert.

That alert routes to an offshore analyst, who updates the tax projection, flags a planning opportunity, and pushes a note into the dashboard. The partner gets a real-time view before the next meeting.

So instead of walking in reactive, they lead with:

“We noticed your projected tax liability jumped, we’d recommend a SEP IRA contribution. That move could save you close to $18,000 this year.”

That’s not extra effort. That’s what happens when your technology works inside your process, not around it.

This isn’t about adding more software. It’s about making the systems you already have work harder, together. So, insight surfaces automatically, and prep doesn’t live on your calendar.

That’s the impact of true technology-driven accounting solutions: not new tools, but smarter orchestration of the ones already in play.

Pillar Two: Process - The Most Overlooked Advantage in Advisory

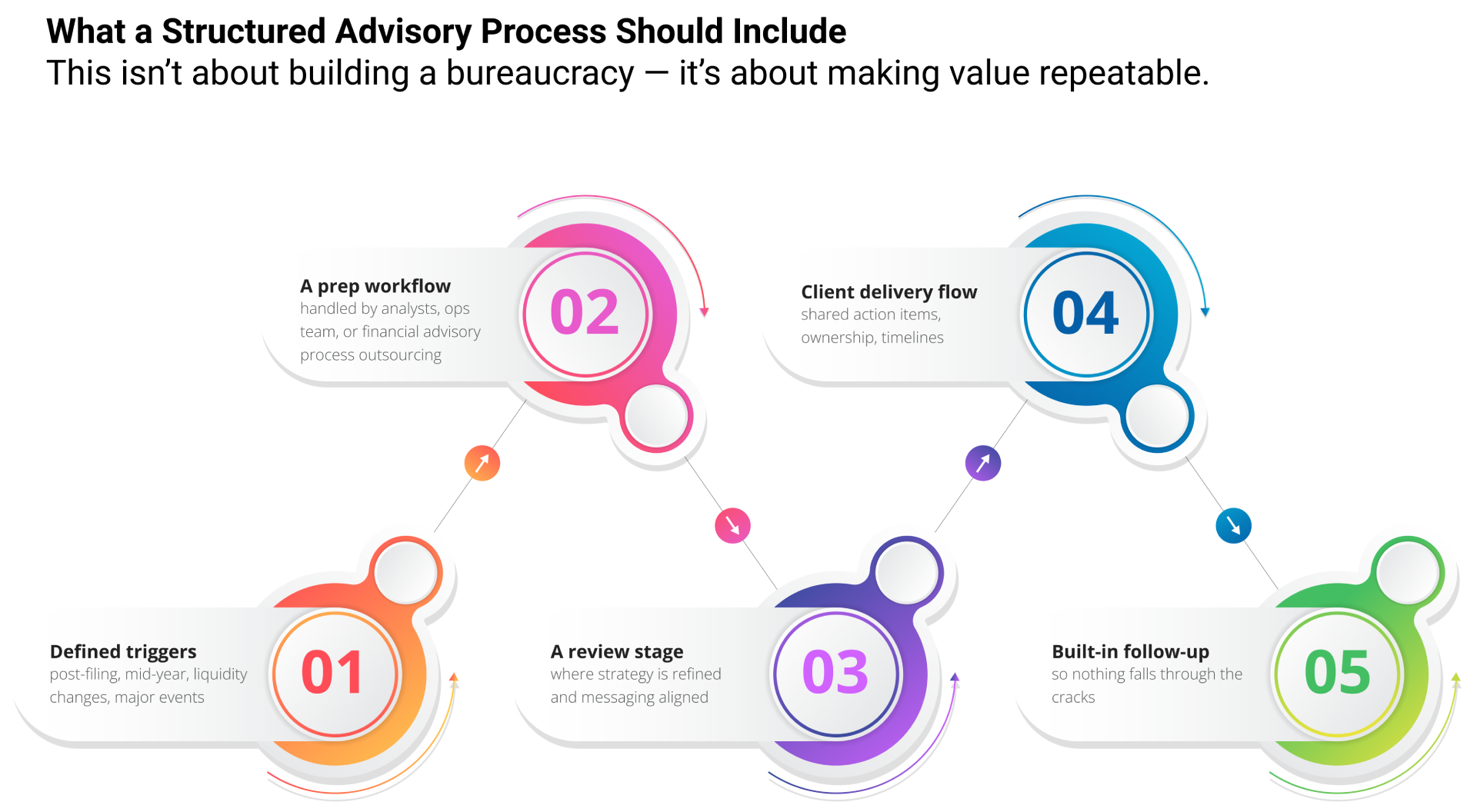

Many firms assume structure will develop over time. That once you’re offering advisory services, the workflows will follow. But the process doesn’t evolve by accident and advisory doesn’t scale without it.

The results of that assumption are easy to spot: partners still handling prep work, clients receiving inconsistent deliverables, and conversations starting too late or not at all.

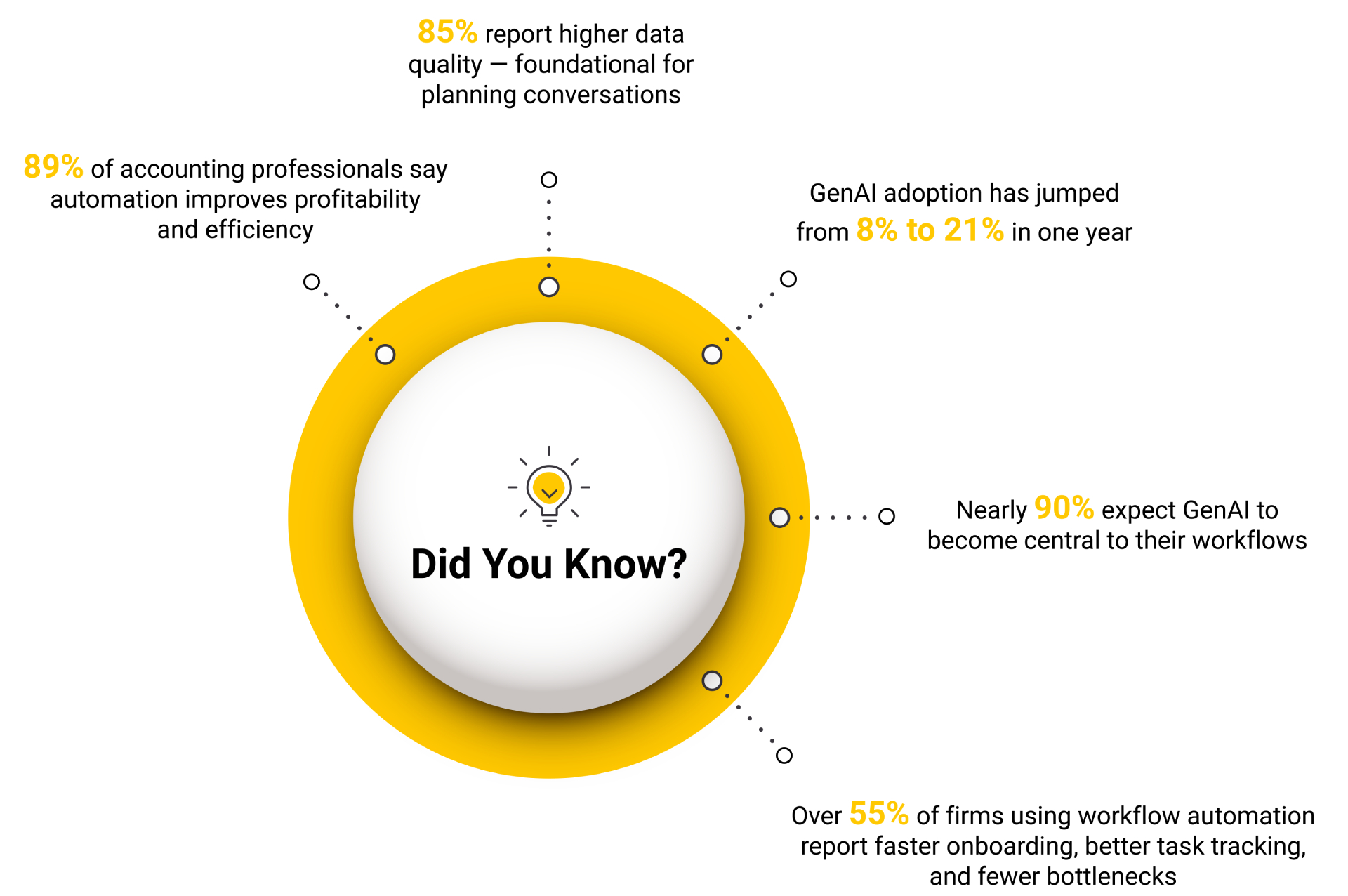

And the impact runs deeper than just inefficiency. According to recent studies, 42% of firms regularly turn down new work due to internal capacity constraints. Nearly 25% cite burnout and operational inefficiency as the biggest barriers to growth. And with over 300,000 professionals exiting the U.S. accounting workforce since 2020, the pressure on remaining teams continues to grow.

That doesn’t mean firms need more people. It means they need more clarity: in how work moves, who owns what, and what happens next. Because when advisory depends on availability instead of structure, it drains the team and dilutes the value. Process doesn’t just help you keep up; it lets you deliver consistently, delegate confidently, and scale sustainably.

But when the process is structured and supported by the right systems and people, advisory becomes predictable, profitable, and far less stressful to deliver. That kind of clarity also frees up your best people to focus on what they do best, which brings us to the third pillar: Talent.

Ready to elevate your advisory services?

Discover how integrating technology, process,

and top talent can transform your firm’s growth.

Pillar Three: Talent - The Pillar That Holds It All Together

Today’s accounting professionals are stretched thin.

A major contributor to this strain is the relentless pressure of compliance work. While essential, compliance consumes vast amounts of time and energy, leaving little bandwidth for proactive advisory. This constant cycle of “must-do” tasks acts like a glass ceiling: capping growth, innovation, and the potential to truly serve clients at a higher level.

We’ve already seen how technology can turbocharge efficiency and automate routine processes, but technology alone isn’t enough.

The next game-changer? Offshoring.

When done right, it’s not just about cost savings; it’s about adding skilled, embedded talent that becomes a natural extension of your team. Offshore staffing unlocks new capacity, taking on compliance and back-office work so your internal experts can focus on strategic advisory that drives real business impact.

Because at the end of the day, everyone deserves a break and the opportunity to grow.

Bringing It All Together: Offshore Staffing 2.0

At Unison Globus, we understand this struggle intimately. Founded by accounting professionals who’ve walked in your shoes, we act as your experienced guide, offering a clear path to reclaim your strategic focus.

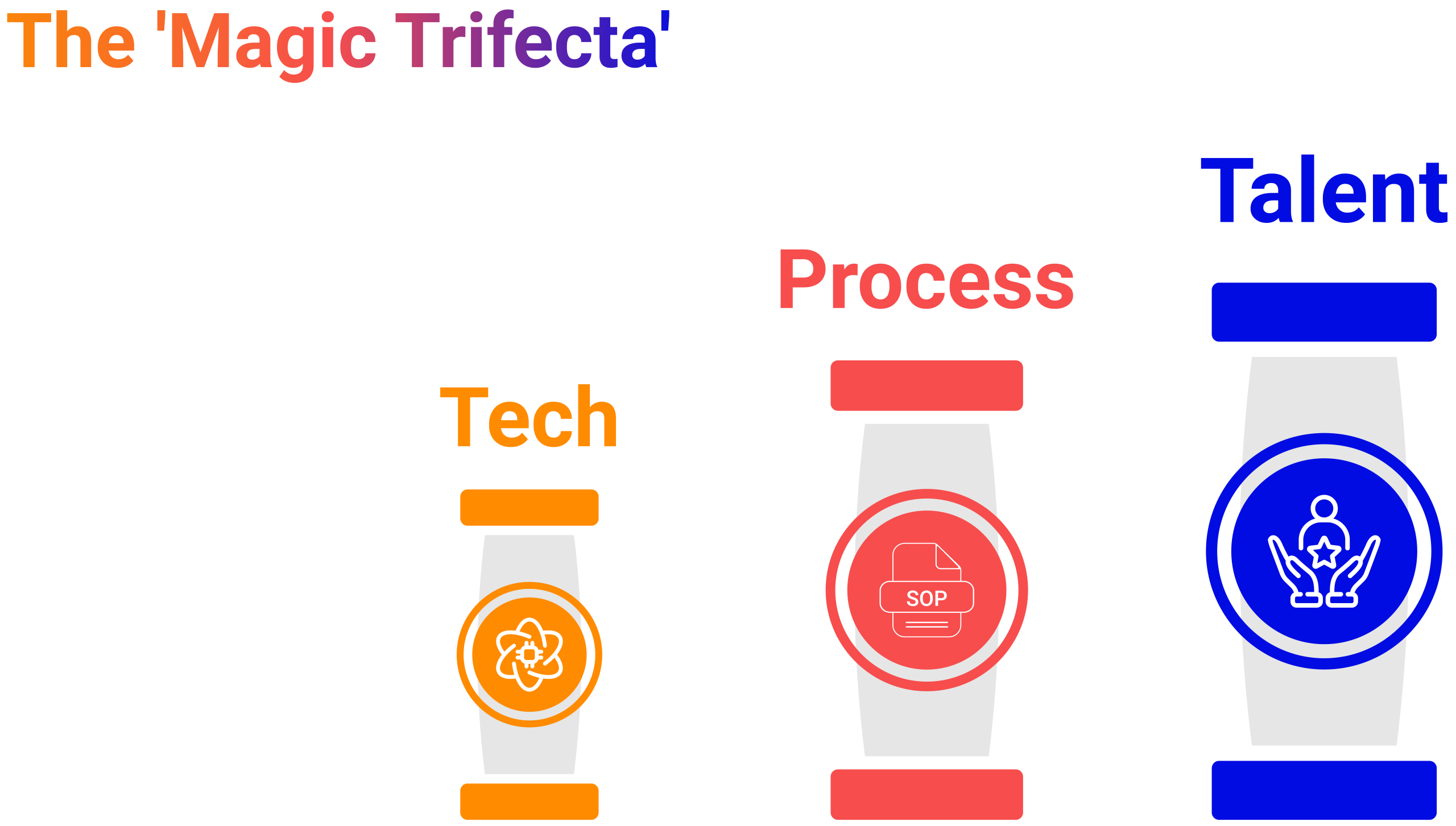

Our proven plan of, built on “Offshoring Staffing 2.0” model and the “Magic Trifecta” of cutting-edge technology, streamlined processes (addressing that critical documentation gap), and top-tier global talent, is specifically designed to offload those time-consuming compliance tasks effectively.

Imagine your senior CPAs, now freed from up to 15-20 hours per week of lower-value work, finally having the bandwidth to cultivate client relationships and drive increased revenue.

Ready to unlock your firm’s advisory potential with Offshore Staffing 2.0?

Contact Unison Globus today to learn how we can help you scale smarter and grow faster.