The way we work has changed forever. Gone are the days when CPA firms were defined by office walls and constrained by local talent pools. The modern firm is borderless, dynamic, and most importantly, flexible.

For CPAs navigating a fiercely competitive landscape, this flexibility isn’t just a perk; it’s survival. Amid chronic talent shortages, relentless client demands, and the rise of advisory-driven accounting, many firms are rethinking their staffing models. And increasingly, the answer they’re finding is offshore accounting talent not as a stopgap, but as a core component of their hybrid workforce strategy.

At Unison Globus, we see this every day. Firms are no longer coming to us with “overflow work” for peak season. They’re asking for help building future-ready teams. They’re using offshore talent not just to “get through busy season” but to redefine how their practices operate year-round.

This isn’t outsourcing as you knew it. This is workforce transformation.

Why CPA Firms Need Flexible Staffing to Stay Competitive

Today’s accounting landscape is marked by two undeniable truths:

01. Talent is scarce.

Nearly 75% of CPA firms cite hiring and retention as their biggest challenge. Recruiting skilled accountants, especially in niche areas like tax advisory or audit, has become a time-consuming and costly endeavor.02. Client expectations are higher than ever.

Compliance work alone doesn’t cut it. Businesses now expect their CPAs to act as strategic advisors, delivering insights, projections, and guidance.

The challenge? Most firms are stuck in a cycle where their highly qualified accountants are bogged down by transactional work, such as reconciling accounts, preparing returns, and chasing documents, leaving little room for higher-value services. Flexible staffing for CPA firms solves this problem.

With remote accounting teams integrated into their operations, firms can dynamically scale their workforce based on demand. This isn’t just about filling gaps during tax season. It’s about creating the capacity to grow, innovate, and meet client needs without overextending local teams.

Beyond Outsourcing: How Offshore Accounting Talent Builds a Hybrid Workforce

For many firms, the word “outsourcing” still suggests low-cost, back-office work. But in today’s accounting world, that definition no longer fits. The demands on CPA firms have evolved, and so has the way they build their teams.

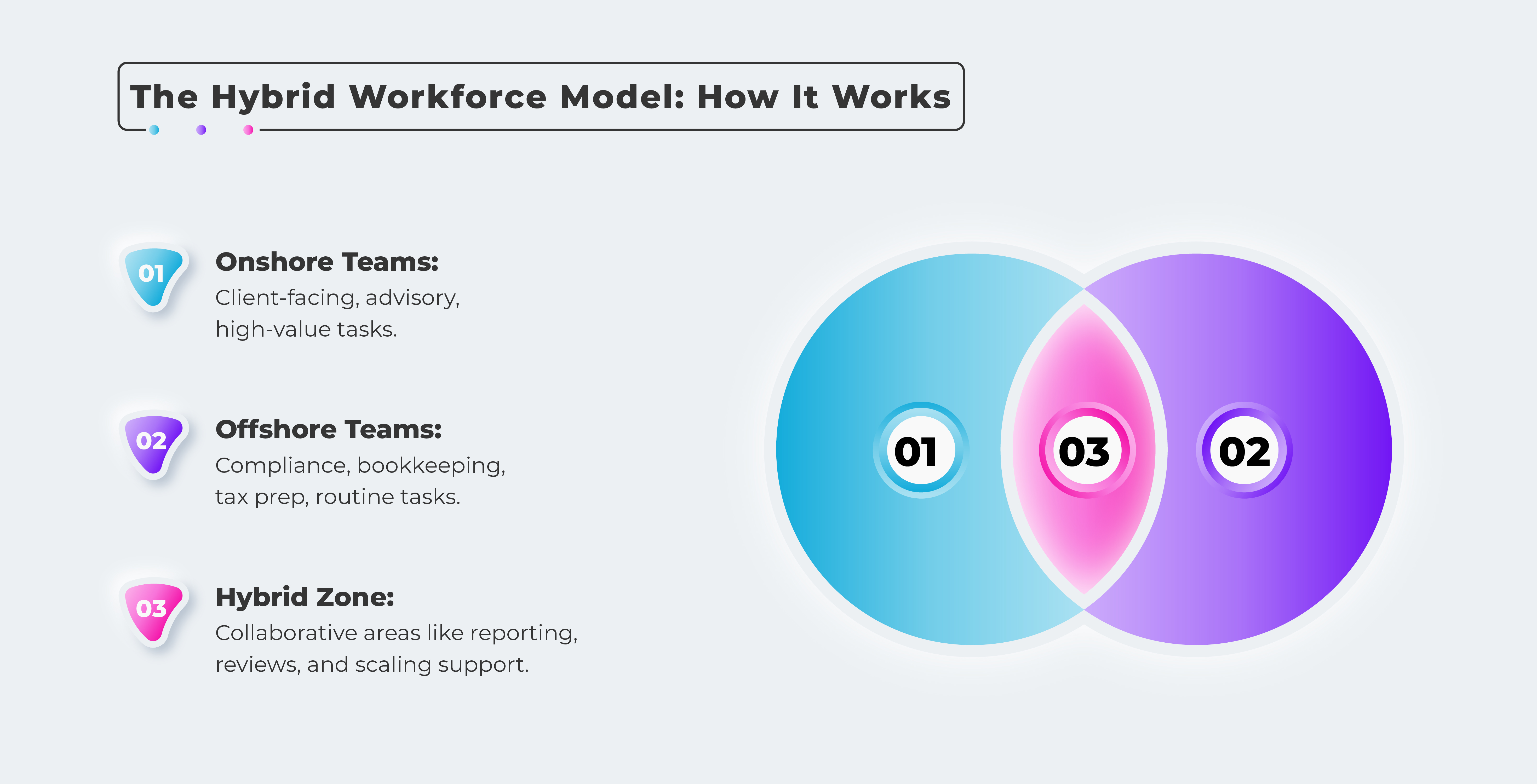

Forward-looking firms are adopting a hybrid workforce model by blending in-house expertise with skilled offshore accounting talent to create a flexible, scalable team structure. This is not about outsourcing tasks and walking away. It is about integrating remote accounting teams as a true extension of the firm, ensuring year-round support and the ability to scale as client needs change.

Here’s what this hybrid approach looks like in practice:

- Year-Round Integration: Offshore professionals are part of the team, consistently managing bookkeeping, payroll, and compliance tasks beyond just busy season.

- On-Demand Scaling: Whether it is a tax season surge or a large client project, firms can quickly expand their capacity without the costs and delays of long-term hiring.

- Empowering Local Teams: With routine work handled by offshore talent, in-house CPAs are free to focus on client relationships, advisory services, and growth initiatives.

This isn’t traditional outsourcing. It is a future-ready workforce strategy that leverages CPA outsourcing services to give firms the agility, bandwidth, and expertise they need to thrive.

CPA Outsourcing for Tax Season: How Offshore Support Reduces Stress and Increases Capacity

Let’s face it, tax season has always been the ultimate stress test for CPA firms. Long hours, mounting pressure, and a near-impossible balancing act between deadlines and quality.

But firms leveraging offshore support for tax season are rewriting the script.

At Unison Globus, we work with firms to prepare months in advance, ensuring that offshore teams are trained, aligned with firm processes, and ready to hit the ground running when Q1 begins.

The result?

- Less burnout for local teams.

- Faster turnaround times.

- Improved accuracy and compliance.

In other words, CPA outsourcing for tax season isn’t just a relief. It’s a competitive advantage.

Different Hybrid Workforce Models for CPA Firms (With Real-World Examples)

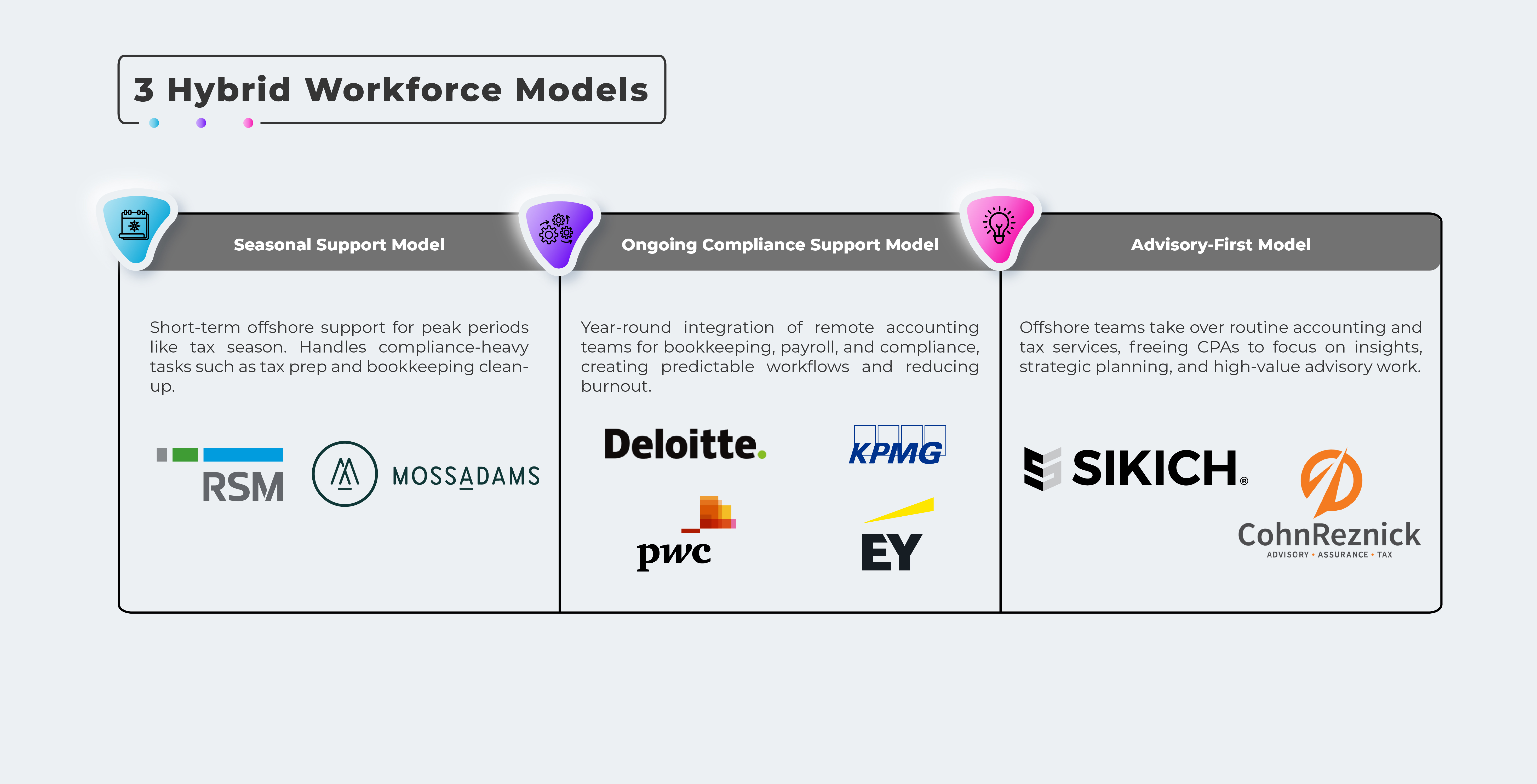

Every firm’s needs are different. A solo practitioner looking for seasonal help will structure their hybrid team differently than a mid-size CPA firm aiming for year-round support. Here are three common hybrid workforce models that firms are using today, along with examples of how leading accounting firms are putting them into practice:

01. Seasonal Support Model

This model is ideal for firms that need offshore support for tax season or other peak periods. Offshore teams handle compliance-heavy tasks such as tax preparation, bookkeeping cleanup, and reconciliations, allowing in-house staff to focus on client communication and review work.Example: U.S.-based mid-sized firms like RSM US and Moss Adams are leveraging offshore teams in India to handle large volumes of tax preparation work during peak seasons, freeing their U.S. CPAs to focus on client-facing and advisory responsibilities (Reuters).

02. Ongoing Compliance Support Model

This model is designed for firms seeking remote accounting teams to manage bookkeeping, payroll, and compliance tasks consistently throughout the year. It creates predictable workflows, reduces burnout for local teams, and builds steady offshore relationships. Within two years, their offshore structure evolved into a fully integrated extension of their practice:Example: The Big Four firms (Deloitte, PwC, EY, KPMG) use large-scale global capability centers, particularly in India, where over 140,000 professionals support audit, tax, and compliance operations for U.S. clients while maintaining client-facing work locally (Reuters).

03. Advisory-First Model

This model works best for growth-focused firms that want to scale advisory services. Offshore teams take on routine accounting and tax services for CPAs, freeing up local CPAs to deliver insights, strategic planning, and advisory work that drives higher revenue.Example: Firms like Sikich and CohnReznick are pairing offshore staffing with technology investments to offload transactional tasks, enabling their in-house teams to focus more on advisory and consulting engagements (Business Insider).

Why It Works

The strength of the hybrid approach lies in its flexibility. Firms can start with one model and evolve as their needs change. Whether it is short-term capacity for tax season, year-round compliance support, or freeing up senior staff for high-value advisory services, hybrid staffing provides a scalable solution that grows with the firm.

What Smart Firms Know About Building Remote Accounting Teams

Firms that successfully implement hybrid workforce strategies are doing more than outsourcing tasks. They are strategically building remote accounting teams that strengthen their capacity, improve efficiency, and free up in-house staff for higher-value work.

Over 25% of CPA firms already use offshore teams, and more than 75% of them plan to expand this support next year. These firms also report improved efficiency and higher output, showing that hybrid staffing is more than cost reduction. It is a proven growth strategy.

Here’s what these firms are doing differently:

01. Prioritizing Quality Partnerships

Successful firms choose trusted providers like Unison Globus for CPA outsourcing services that deliver consistent quality and align with U.S. accounting standards.02. Integrating Offshore Talent Seamlessly

The best remote accounting teams are treated as part of the firm. They use the same tools, workflows, and communication channels as local staff to ensure collaboration and alignment.03. Scaling With Flexibility

Instead of over-hiring locally, these firms leverage flexible staffing for CPA firms to handle seasonal surges, project-based needs, and ongoing compliance workloads without overextending resources.Smart firms are not simply filling gaps. They are redesigning their workforce models to create scalable, client-focused operations that thrive in a competitive landscape.

Why Unison Globus is the Go-To Partner for CPA Outsourcing Services

Plenty of firms talk about offshore staffing. Unison Globus takes it further with Offshore Staffing 2.0, a strategic, future-ready approach that integrates skilled offshore professionals into your operations as true extensions of your team.

Here’s why hundreds of CPA firms across the U.S. choose us:

- Specialization in CPA Firms: We provide accounting and tax services for CPAs, so our teams understand the complexities of your workflows, deadlines, and client needs.

- Scalable Solutions: Whether you need one offshore accountant or an entire team, our Offshore Staffing 2.0 model helps you scale at the speed of business.

- Data Security You Can Trust: With ISO-certified infrastructure and stringent compliance protocols, your clients’ data stays protected at every step.

- Proactive, Process-Driven Support: We don’t just complete tasks. We help refine your workflows for greater efficiency and long-term success.

When you work with Unison Globus, you’re not buying capacity. You’re gaining a strategic partner committed to transforming how your firm operates.

The Bottom Line: Offshore

Accounting Talent is the Future

The future of accounting is not about choosing between

in-house or outsourced teams. It is about building

hybrid workforces that combine the strengths of

both, delivering the flexibility, capacity, and expertise

firms need to thrive.

In this future, offshore talent is not an add-on.

It is a core driver of competitive advantage.

If you are ready to:

in-house or outsourced teams. It is about building

hybrid workforces that combine the strengths of

both, delivering the flexibility, capacity, and expertise

firms need to thrive.

In this future, offshore talent is not an add-on.

It is a core driver of competitive advantage.

If you are ready to:

Expand your client base without overloading your team

Boost profitability without increasing fixed costs

Transform your firm into an agile, future-ready practice

Then it is time to explore how offshore accounting talent

can reshape your business.

can reshape your business.

Let’s Build Your Future-Ready Workforce

At Unison Globus, we help CPA firms of all sizes scale smarter, not harder. Through our Offshore Staffing 2.0 approach, we provide CPA outsourcing services for compliance work and build remote accounting teams for year-round support. We deliver the talent, processes, and flexibility you need to grow with confidence.

The future is flexible. Are you ready to embrace it?

[gtranslate]

[gtranslate]