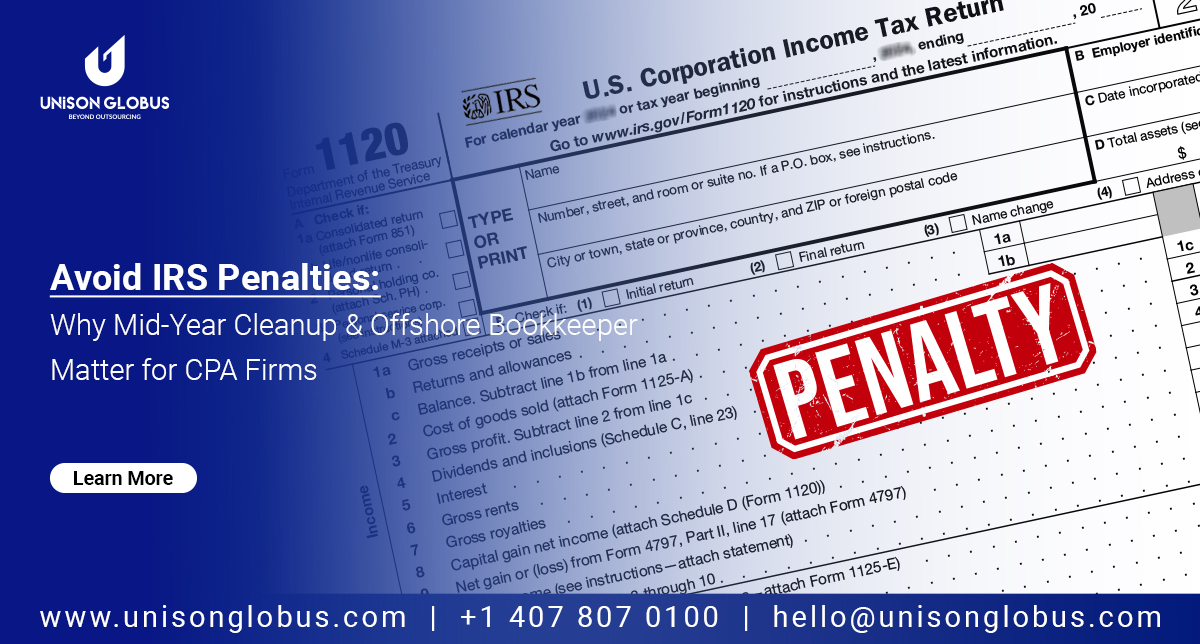

IRS Penalties: A Real Risk for Your Clients

Quick Reference: Key IRS Details

Estimated Tax Deadlines

- Q1: April 15

- Q2: June 15

- Q3: September 15

- Q4: January 15 (next year)

Penalty and Interest

- Underpayment penalty: 0.5% to 5% per month on unpaid amounts

- Interest: Compounded daily at IRS quarterly rates

Safe Harbor Thresholds

- Pay 90% of current year tax or 100% of prior year tax

- For AGI above $150,000: 110% of prior year tax

Why August Is the Right Time to Act

What happens if firms wait? Postponing cleanup until the fall compresses workflows. Extended return filings, yearend reviews, and advisory planning all collide, leaving teams stretched thin, increasing the risk of errors, and forcing lastminute fixes that undermine client confidence. Firms that miss this window often spend more time firefighting than planning.

Acting in August helps firms:

- Complete Form 4868 instructions for individuals and Form 7004 business tax extensions with ample review time before October deadlines

- Prepare accurate Q3 estimated tax submissions, reducing IRS penalty exposure

- Reconcile first half transactions, ensuring reliable financial data for planning

- Fix categorization errors that distort reporting and delay decision-making

- Produce clear, actionable reports that enable meaningful advisory discussions

For many firms, this is also the ideal moment to expand capacity. Whether through process automation or specialized offshore accounting teams, leveraging August to resolve months of unresolved work can transform Q4 from a scramble into a well-planned, profitable, close to the year.

Don’t wait for Q4 to fix Q1 and Q2.

Partner with Unison Globus now for mid-year bookkeeping cleanup, Form 4868 and 7004 preparation, and secure offshore accounting support that keeps your client’s penalty-free. Get in touch now

August Advantage:

Act Now vs Wait

| Act in August | Wait Until Fall |

|---|---|

Extended returns filed ahead of October deadlines Extended returns filed ahead of October deadlines |

Deadlines stack up creating chaos Deadlines stack up creating chaos |

Accurate Q3 estimated tax filings Accurate Q3 estimated tax filings |

Higher risk of penalties and compliance errors Higher risk of penalties and compliance errors |

Backlogs resolved for clean books Backlogs resolved for clean books |

Teams overextended and burned out Teams overextended and burned out |

Advisory-ready reports for better client conversations Advisory-ready reports for better client conversations |

Lost opportunities for planning and growth Lost opportunities for planning and growth |

Why Backlogs Happen and Why They Are Hard to Clear

The Hidden Roadblocks

- Unreconciled accounts from earlier quarters delay accurate financial reporting.

- Incomplete or missing documentation creates gaps that take hours to fill.

- Delayed client responses lead to unpredictable timelines and stalled workflows.

- Inconsistent categorization skews financial reports and complicates cleanup.

- Data scattered across multiple platforms increases the time spent on manual work.

Why This Puts Firms at Risk

Midyear bookkeeping backlogs do more than slow down day today operations. Incomplete reconciliations and delayed financial updates create gaps that increase audit exposure, leaving firms vulnerable if the IRS or state agencies request supporting documentation.

They also push out delivery timelines, making it harder to meet client expectations for timely financial statements, tax estimates, and planning insights. In a profession where trust is tied directly to reliability, these delays can erode client confidence and strain relationships.

Perhaps most critically, these backlogs drain a firm’s most valuable resource: its people. Partners, managers, and senior accountants often end up handling catchup bookkeeping and transaction cleanup. This forces senior staff into firefighting mode, leaving little time for innovation, business development, or deep client engagement. Over time, this reactive approach weakens the firm’s competitive edge and diminishes its ability to deliver differentiated, high value services.

In short, when bookkeeping cleanup lags, firm capacity shrinks, risks rise, and growth stalls, precisely when clients need their advisors to lead with clarity and foresight.

The Measurable Impact

- 65% of small businesses fall behind on bookkeeping in the first half of the year.

- The IRS assessed over $1 billion in underpayment penalties in 2024, much of it linked to inaccurate or delayed filings.

- Audit risk increases by up to 40 percent when documentation is incomplete or inconsistent.

- CPA firms lose 10 to 15 hours per client manually reconciling backlogged data.

Turn Backlogs into Opportunity - Act Now with Unison Globus

For firms already stretched thin, tackling multi-month backlogs internally often means sacrificing advisory projects or pushing teams toward burnout. Partnering with experienced offshore bookkeeping services for CPA firms can change that.

With more than 19 years of experience and a 500-plus member team, Unison Globus helps CPA firms resolve 3–12 months of backlog in as little as 2–4 weeks while ensuring IRS-compliant, paperless workflow for tax season and seamless collaboration across platforms like QuickBooks, Xero, Sage, and NetSuite.

The results speak for themselves:

- Lower overhead by avoiding the cost and time of hiring and training in-house

- Scalable capacity to flex resources based on seasonal demand

- Improved compliance with reduced penalties and audit exposure

- Enhanced client service through timely, accurate reporting and insights

[gtranslate]

[gtranslate]