Introduction – The Compliance Trap

Every accounting firm knows the feeling. The endless pile of tax returns. The reconciliations that never seem to end. The long nights where you are checking boxes instead of checking in with clients. For many firms, compliance has become an anchor that weighs them down.

The cost is not just internal exhaustion. When a firm is buried in compliance, clients miss out on the client advisory services (CAS) they desperately need. They are left without timely guidance on cash flow, profitability, and strategic growth. Partners and managers are reactive responders, not proactive advisors.

But here is the truth: compliance is essential, yet it should never define your firm. By offloading routine tasks to a world-class offshore team at Unison Globus, firms create the capacity to step into the role of trusted advisor. This blog explores the shift from backlog to breakthrough, and how your firm can transform its future.

The Backlog Problem – Why Firms Stay Reactive

Compliance-heavy workloads are the single biggest reason firms stay reactive. Every season brings the same pressures:

- Deadlines pile up, creating constant backlog stress.

- Partners spend more time chasing forms than meeting clients.

- Advisory conversations are postponed because “we just do not have the bandwidth.

It is a vicious cycle. The more compliance dominates, the less capacity exists for accounting advisory services. The backlog eats into the energy and focus needed for high-value work.

Firms stuck here often report:

- Burnout across teams due to long hours on low-margin tasks

- Clients viewing the firm as transactional, not strategic

- Missed opportunities to deliver financial advisory for clients at crucial business moments

This reactive posture creates risk. When accountants are too busy producing reports, they cannot provide advisory services for businesses that help them navigate the future.

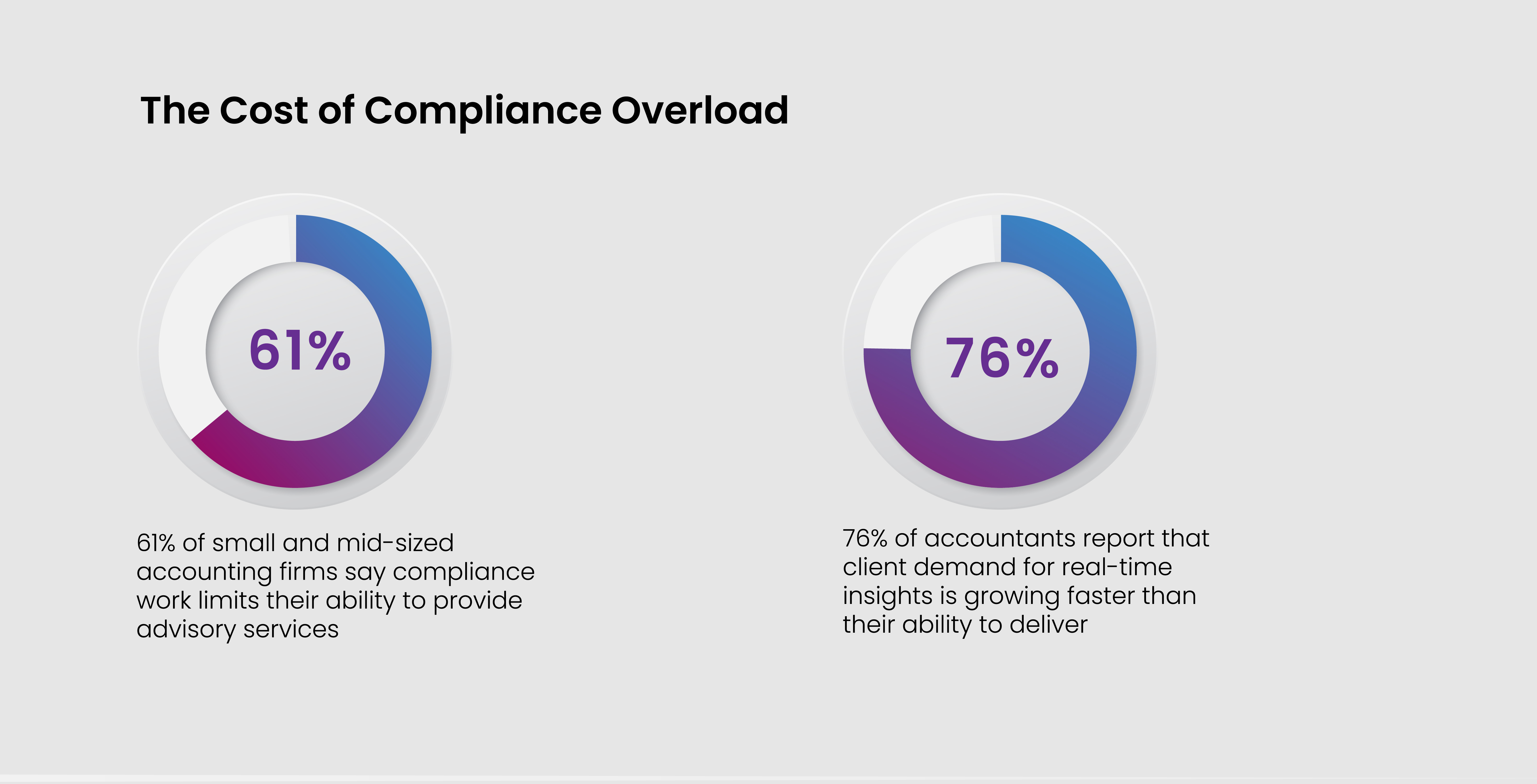

The Rising Demand for Advisory

Meanwhile, the marketplace is shifting. Business owners no longer want accountants who only deliver compliance. They want forward-looking insight. They want trusted guidance on decisions that affect tomorrow, not just yesterday’s numbers.

SMBs in particular are asking for:

- Business advisory services that help them plan expansion, manage risk, and unlock profitability

- Strategic financial advisory for clients who need to manage debt, invest wisely, and stabilize growth

- Practical forecasting and budgeting services that allow them to plan for seasonality, funding, or growth cycles

- Ongoing cash flow advisory for businesses to prevent shortfalls and improve resilience

This demand is only growing. Firms that continue to operate as compliance-only providers risk losing relevance. On the other hand, those who step into business advisory for SMBs position themselves as indispensable.

Advisory is not optional anymore. It is what clients expect, and what differentiates forward-looking firms from those stuck in the past.

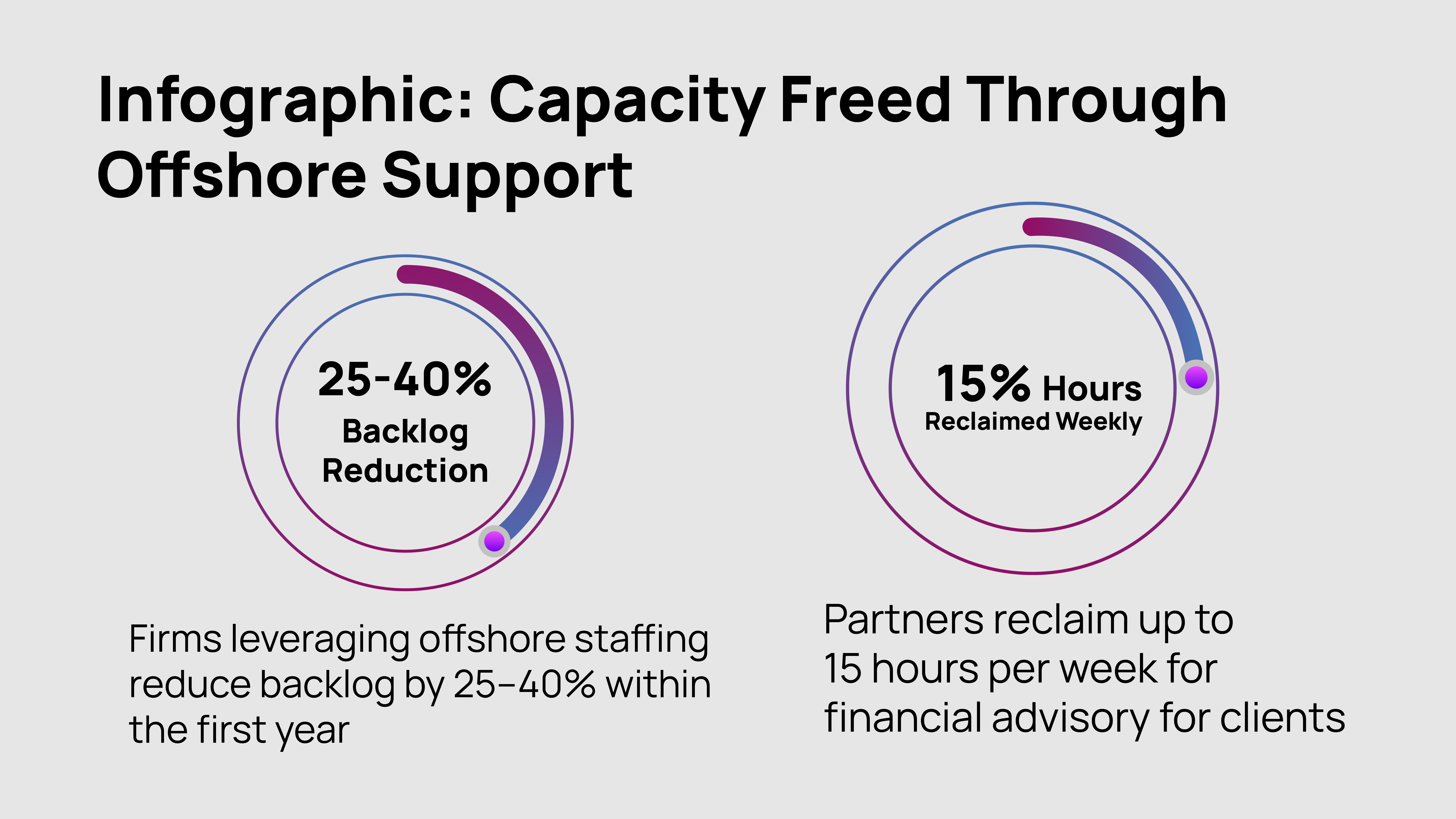

The Breakthrough – Unlocking Capacity with Offshore Staffing

So how do firms make the leap from backlog to advisory? The breakthrough is not about working harder. It is about creating capacity.

That is where Unison Globus Offshore Staffing 2.0 comes in. By strategically offloading compliance-heavy tasks to a skilled offshore team, firms:

- Clear backlogs without burning out their in-house staff

- Free up partner and manager time for high-value activities

- Gain breathing room to actually design accounting advisory services offerings

Consider what this looks like in practice:

- Offshore professionals handle reconciliations and bookkeeping while partners prepare cash flow advisory for businesses

- A manager once buried in tax filings now has time to develop forecasting and budgeting services for clients

- An entire in-house team moves from reactive reporting to proactive business advisory services that build long-term client trust

This is not about outsourcing advisory itself. It is about building the foundation that makes advisory possible. Offshore support clears the path so firms can finally walk into the role clients have always wanted them to play.

From Reactive to Proactive – A Practical Shift

Moving from backlog to breakthrough does not happen overnight. It requires a structured shift in how firms operate.

Step 1: Offload compliance bottlenecks.

Identify the tasks that drain the most time but add the least client-facing value. Bookkeeping, reconciliations, and tax prep are prime candidates for offshore staffing.Step 2: Reallocate partner and manager time.

With compliance covered, leaders can focus on strategic discussions and building advisory services for businesses.Step 3: Build structured offerings.

Package services such as forecasting and budgeting services, cash flow advisory for businesses, and growth planning into clear client deliverables.Step 4: Proactively engage clients.

Do not wait for clients to ask. Set quarterly or monthly check-ins where insights are shared. This is how firms reposition from reactive compliance shops to proactive advisors.

When executed well, this shift elevates both client satisfaction and firm profitability. Advisory services typically command higher margins and deeper loyalty than compliance work.

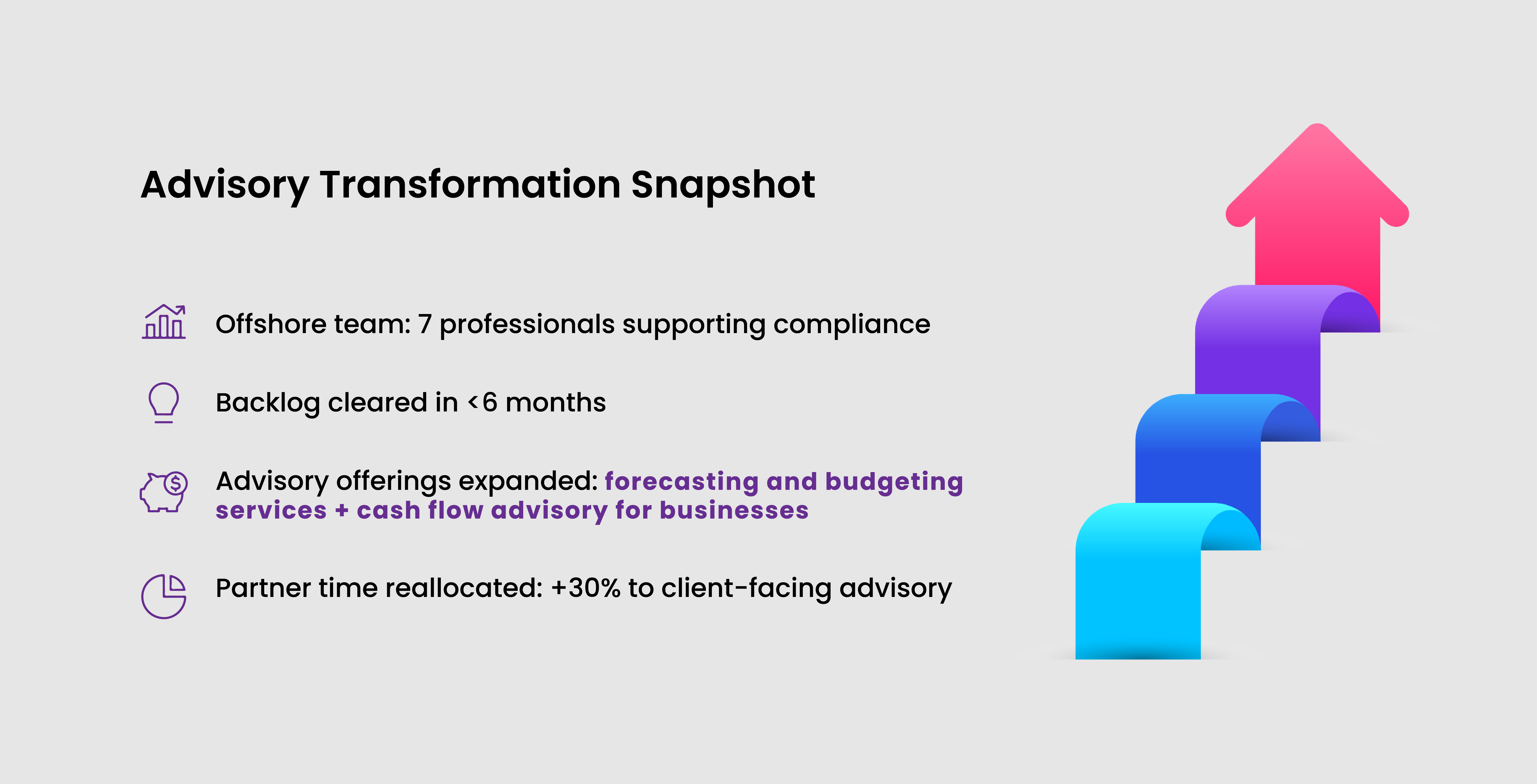

Case-in-Point: From Backlog to Breakthrough

In 2019, a U.S.–U.K. tax advisory firm partnered with Unison Globus to tackle a critical backlog of expat tax filings. At the time, compliance consumed so much of the team’s bandwidth that client requests for budgeting and cash flow support were often deferred.

The firm started small, but over the next five years built a 7-person offshore team. With compliance now handled seamlessly, the partners freed nearly 30 percent of their time. That reclaimed capacity became the turning point.

Instead of deflecting advisory requests, the firm introduced forecasting and budgeting services tailored to international clients. They also began offering proactive cash flow advisory for businesses, which became one of their most in-demand services.

What began as a stop-gap to solve backlog issues became a long-term breakthrough. Today, their offshore team handles compliance with precision, while the in-house team leads with insight, strategy, and trusted guidance.

Conclusion – From Backlog to Breakthrough

Compliance will always matter, but it should never define your firm. Staying reactive keeps you trapped in the past. Clients expect more, and they are willing to pay for it.

The firms that thrive are the ones that embrace offshore support as a lever for transformation. By partnering with Unison Globus Offshore Staffing 2.0, you can:

- Eliminate backlogs that drain your team

- Reclaim capacity for client advisory in accounting

- Deliver business advisory services that secure loyalty and fuel growth

- Position your firm as the trusted partner clients want by their side

From backlog to breakthrough, the path is clear. Your clients are waiting for proactive, trusted advice. With Unison Globus, your firm can finally deliver it.

Ready to reclaim your time and transform the way you serve your clients? Let’s talk.

[gtranslate]

[gtranslate]