Explore how Unison Globus can help U.S. CPA firms outsource tax preparation to India for cost savings, operational scalability, and enhanced client service. Learn about the benefits of partnering with a trusted outsourcing provider for seamless, efficient tax solutions.

The U.S. tax landscape has always been intricate, shaped by evolving regulations and an increasing demand for precise, timely tax preparation. As tax deadlines tighten and compliance requirements grow more complex, Certified Public Accountants (CPAs) are increasingly seeking ways to streamline operations without compromising on accuracy or client service.

One of the most effective strategies to achieve this is outsourcing tax preparation to global partners, with India emerging as a leading destination for offshore tax preparation services.

In this guide, we’ll explore the growing trend of tax outsourcing solutions and examine why U.S. CPA firms are turning to India to address the challenges of tax preparation. Whether you’re considering outsourced tax services for the first time or looking to optimize your existing CPA firm outsourcing strategy, this blog will offer valuable insights into why India has become the go-to hub for outsourced tax services for CPA firms, offering unmatched expertise, cost-efficiency, and scalability during peak tax seasons.

Why India ? The Advantage of Outsourcing Tax Preparation

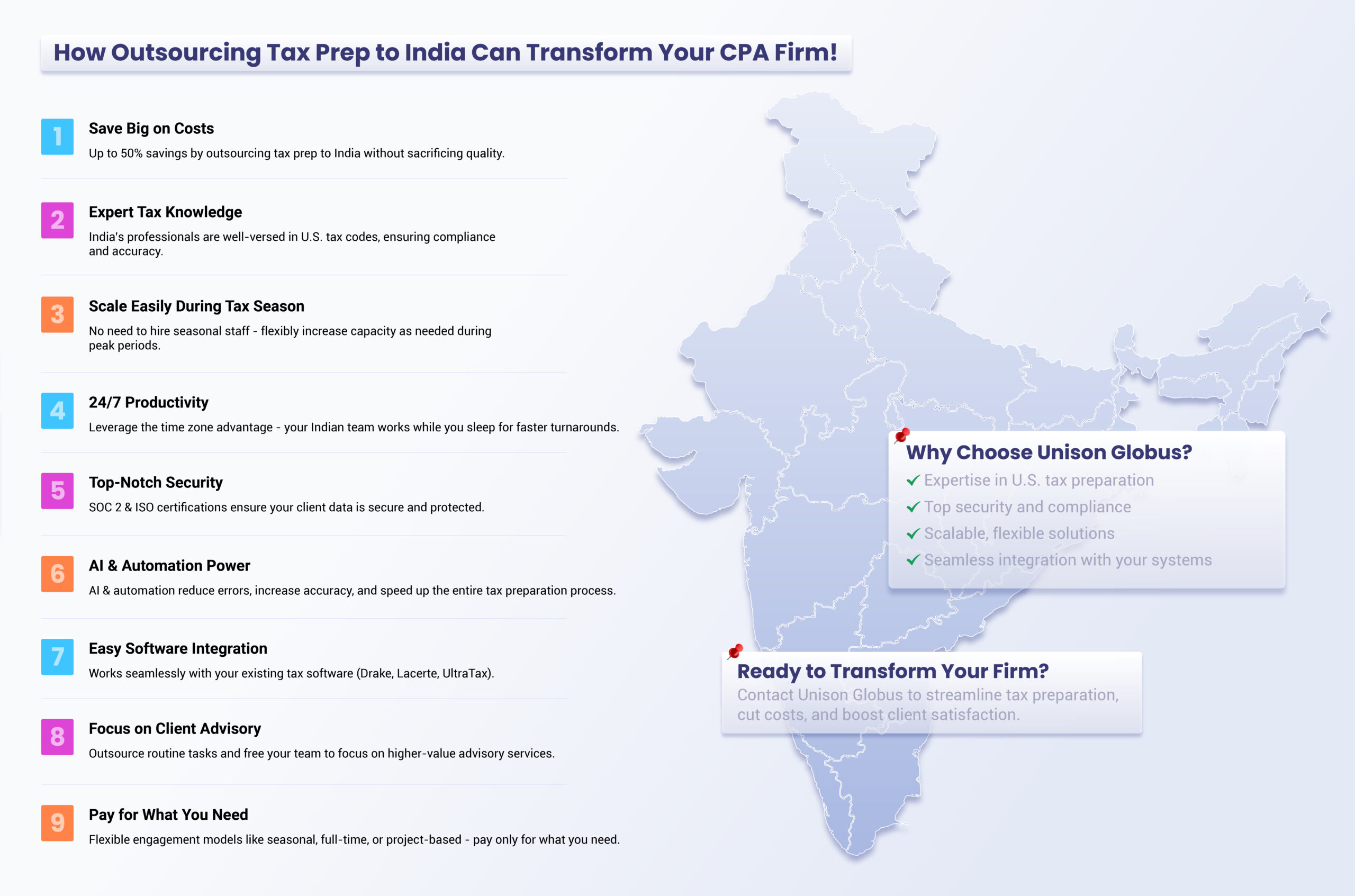

India has long been recognized as a global powerhouse in outsourcing, and its role in the tax preparation outsourcing sector is no exception. As U.S. CPA firms face increasing pressure to deliver timely and accurate services, India offers a strategic advantage for firms looking to optimize operations. Here’s why India is the preferred choice for tax outsourcing solutions:

Skilled Workforce with Expertise in U.S. Tax Law and IRS Compliance:

India boasts a highly educated workforce that is well-versed in the complexities of U.S. tax laws and IRS compliance. Whether it’s preparing individual returns like 1040 or business returns such as 1120 and 1065, Indian outsourcing partners bring a wealth of knowledge and experience in handling U.S.-specific tax requirements. This deep expertise ensures that tax returns are not only accurate but also aligned with ever-evolving IRS regulations.Cost Efficiency and Scalability Without Compromising Quality:

One of the most compelling reasons CPA firms are increasingly outsourcing to India is the significant cost savings it offers. By outsourcing, firms can reduce operational overheads such as hiring full-time staff or investing in costly infrastructure – without sacrificing quality. Indian partners also offer scalability, meaning that as your firm grows or experiences spikes during busy seasons like tax season outsourcing, they can quickly ramp up capacity to meet your needs without additional stress on your in-house team.Time Zone Advantage for Faster Turnaround and Quicker Client Response:

The time zone difference between the U.S. and India becomes a strategic asset, especially during peak periods like tax season. While U.S. firms are offline, Indian outsourcing teams can continue working on your tax returns, offering faster turnaround times and ensuring quicker responses to your client needs. This round-the-clock productivity can make a significant difference in meeting tight deadlines, ensuring your firm can deliver exceptional service even during the busiest times of the yearSecure, Paperless Workflows with Industry-Leading Data Protection:

Security is a top priority when dealing with sensitive tax information. Indian outsourcing providers are committed to maintaining the highest standards of data security. Many adhere to strict protocols like SOC 2 and ISO certifications, ensuring your clients’ sensitive data is always protected. Additionally, India-based outsourcing partners embrace paperless workflows, reducing the risk of data breaches and providing an efficient, environmentally friendly solution to handling documents.What Services Can Be Outsourced?

When you choose to outsource tax preparation to India, you gain access to a wide range of services that help lighten your firm’s workload and expand its capabilities. Here are the key services you can confidently outsource:

Individual and Business Tax Return Preparation

Outsourcing partners can handle all aspects of tax return preparation, from individual returns like 1040 to corporate returns such as 1120 and partnership returns like 1065. With Indian teams trained in IRS compliance, you can ensure that every return is accurate, timely, and filed according to the latest tax laws.Tax Extensions, Estimated Payments, and IRS Notice Responses

Managing critical tax deadlines is no small task. An outsourcing partner can handle the administrative burden of filing tax extensions, processing estimated payments, and responding to IRS notices, allowing your in-house team to focus on more complex client needs and strategic advisory work.Bookkeeping, Payroll, and Sales Tax Filings

Many Indian outsourcing providers extend their services beyond tax preparation to include essential accounting functions such as bookkeeping, payroll processing, and sales tax filings. This allows CPA firms to offer a comprehensive suite of services to their clients, all without the need for additional in-house personnel.Audit Support and Client Advisory Documentation

Outsourced teams can assist in preparing detailed audit support materials and client advisory documentation, enabling your in-house professionals to focus on high-value, strategic advisory services. Whether you need detailed reports for audits or comprehensive client plans, Indian outsourcing partners are equipped to handle these tasks efficiently and accurately.Benefits for CPA Firms and Small Businesses

Outsourcing tax preparation provides a wealth of advantages for CPA firms and small businesses, driving efficiencies, enhancing service offerings, and improving overall profitability. By leveraging the expertise of offshore tax preparation partners, firms can experience substantial operational improvements. Here’s how:

Reduced Operational Costs

Outsourcing enables CPA firms to significantly cut operational costs. With tax outsourcing solutions, firms no longer need to hire temporary or seasonal staff, nor do they need to invest heavily in technology or infrastructure to manage peak workloads. By delegating tax preparation tasks to a reliable outsourcing partner, firms can allocate resources more efficiently and reinvest savings into areas that generate long-term growth.Increased Capacity During Tax Season

Tax season can be a daunting period for CPA firms, as workloads spike and deadlines loom. Tax season outsourcing allows firms to scale their operations without the hassle of hiring additional full-time staff. Whether it’s preparing a higher volume of returns or handling more complex tax issues, outsourcing gives your firm the flexibility to increase capacity precisely when you need it most, ensuring your clients receive timely and accurate service.Improved Accuracy and Compliance

With the complexity of U.S. tax codes and ever-changing IRS regulations, accuracy and compliance are non-negotiable. By partnering with an experienced outsourcing provider like Unison Globus, you benefit from a team that is highly skilled in navigating IRS rules and regulations. This expertise reduces the risk of errors and ensures your clients’ tax returns are filed with the utmost accuracy, minimizing the risk of audits, penalties, and other compliance issues.Focus on Client Advisory and Strategic Services

Outsourcing non-core tasks like tax preparation frees up your in-house team to focus on more valuable activities. By removing the burden of routine tax filing, your professionals can dedicate more time to client advisory and strategic planning, offering higher-value services that help build long-term client relationships. With more time to invest in business consulting, financial planning, and tax-saving strategies, you can position your firm as a trusted advisor rather than just a tax preparer.Potential Challenges and How to Mitigate Them

While outsourcing offers substantial benefits, it’s important to address potential challenges:

- Data Security Concerns Data security is paramount. By partnering with a SOC 2 or ISO-certified outsourcing provider, you can ensure that your clients’ sensitive data is protected with industry-leading security measures.

- Communication Gaps Clear communication is key. Establishing Standard Operating Procedures (SOPs) and using collaboration tools like cloud-based project management platforms can mitigate any communication issues that may arise.

- Quality Control To maintain high service standards, implement robust review processes and Service Level Agreements (SLAs) to ensure quality and timeliness of the work delivered by your outsourcing partner.

Ready to elevate your firm’s performance?

Reach out to Unison Globus today to discover how our customized tax outsourcing solutions can streamline your operations, reduce costs, and enable your firm to provide even more strategic value to your clients. Contact Us

Potential Challenges and How to Mitigate Them

While outsourcing offers substantial benefits, it’s important to address potential challenges:

- Data Security Concerns

Data security is paramount. By partnering with a SOC 2 or ISO-certified outsourcing provider, you can ensure that your clients’ sensitive data is protected with industry-leading security measures. - Communication Gaps

Clear communication is key. Establishing Standard Operating Procedures (SOPs) and using collaboration tools like cloud-based project management platforms can mitigate any communication issues that may arise. - Quality Control

To maintain high service standards, implement robust review processes and Service Level Agreements (SLAs) to ensure quality and timeliness of the work delivered by your outsourcing parter.

Choosing the Right Tax Preparation Outsourcing Partner

When selecting an outsourcing partner for CPA firms, it’s essential to evaluate:

Selecting the right outsourcing partner for CPA firms is a critical decision that can directly impact your firm’s efficiency, compliance, and overall success. To ensure a smooth collaboration, you must carefully evaluate potential partners on several key criteria. Here’s what to look for:

Experience and Certifications

When considering an outsourcing partner, it’s crucial to prioritize experience in U.S. tax preparation and a deep understanding of IRS compliance. Your ideal partner should have a proven track record of handling a range of tax forms (e.g., 1040, 1120, 1065) and be up to date with the latest tax laws and regulations. Additionally, look for certifications such as SOC 2 and ISO that demonstrate a commitment to security and quality. These credentials provide assurance that your partner has the expertise to manage your clients’ sensitive financial data with the highest level of professionalism.Client References and Case Studies

Reliability and trustworthiness are essential when outsourcing tax services. Request client testimonials, case studies, or references from firms with similar needs to gauge your potential partner’s performance and reliability. Reading about real-world experiences from other CPA firms can give you valuable insights into the outsourcing provider’s ability to meet deadlines, maintain accuracy, and scale services during peak periods like tax season.Trial Projects for Workflow and Quality Assessment

Before entering into a long-term agreement, start with a trial project. This allows you to assess the outsourcing partner’s quality of work, communication, and workflow management in real-time. A trial project helps you identify potential issues early, whether related to turnaround times, communication gaps, or quality control. This hands-on evaluation ensures that you’re partnering with a provider who meets your expectations, offering you peace of mind before committing to a full-scale outsourcing arrangement.Best Practices for Outsourcing Tax Preparation to India

To ensure a seamless outsourcing experience when partnering with offshore tax services in India, following industry best practices is key. By taking a proactive and strategic approach, CPA firms can maximize the benefits of outsourcing while minimizing potential risks. Here’s how to ensure your tax outsourcing partnership is successful:

Start Early:

Timing is crucial when it comes to outsourcing tax preparation. Initiate the process early (ideally from October to December) to allow for a smooth onboarding experience. Starting early gives you and your partner ample time to establish workflows, train teams, and address any potential challenges before the busy tax season kicks in. Early preparation helps avoid the rush, ensuring quality results and timely tax return submissions.Align Workflows and Expectations Across Teams:

Effective collaboration between your in-house team and the outsourced team is crucial. Aligning workflows, timelines, and procedures ensures that both teams understand their roles and responsibilities. This alignment prevents delays, improves efficiency, and guarantees that client deadlines are met with precision. Establish Standard Operating Procedures (SOPs) to clearly define each step in the tax preparation process, from document collection to final filing.Utilize Secure Portals for File Sharing and Communication:

Data security is a top priority in tax preparation. To protect sensitive client data, use secure cloud-based portals for file sharing and communication. Ensure that your outsourcing partner adheres to industry-leading security standards, such as SOC 2 or ISO certifications, to safeguard your firm’s and clients’ information. A secure, paperless system not only improves efficiency but also helps mitigate data breaches, maintaining confidentiality and compliance with privacy regulations.Schedule Regular Check-Ins and Performance Reviews:

Maintaining ongoing communication is critical to a successful outsourcing relationship. Schedule regular check-ins and performance reviews with your outsourcing partner to evaluate progress, address concerns, and make necessary adjustments. These reviews help identify potential issues early, such as workflow bottlenecks or missed deadlines, ensuring that your firm stays on track and delivers high-quality service to clients. Regular communication fosters continuous improvement and strengthens the partnership.Why Hire an Outsourced Tax Preparation Partner in India?

Outsourcing tax preparation to India offers a strategic advantage for CPA firms looking to optimize operations, reduce costs, and enhance service offerings. By partnering with an experienced outsourcing provider like Unison Globus, your firm can leverage several key benefits, allowing you to scale effectively and provide exceptional client service. Here’s why Unison Globus should be your trusted partner for tax outsourcing solutions:

- Strategic Advantage for Scaling: India offers flexibility in engagement models, whether you need seasonal, full-time, or project-based support.

- Access to Specialized Tax Teams: Benefit from a team with specialized knowledge in tax preparation for CPA firms.

- Operational Flexibility: Scale up or down depending on your needs, ensuring that you only pay for the resources you need

Why Choose Unison Globus?

Unison Globus is the ideal partner for CPA firms seeking reliable, scalable, and secure outsourcing solutions. Here’s why:

Expertise in U.S. Taxation

With a dedicated team skilled in U.S. tax codes and IRS compliance, Unison Globus ensures accurate and timely tax return preparation, minimizing errors and ensuring compliance.Security & Compliance

Adhering to strict SOC 2 and ISO standards, Unison Globus protects your clients’ sensitive data with secure, paperless workflows, giving you peace of mind.Tailored Solutions

Offering flexible engagement models like seasonal, full-time, or project-based — Unison Globus adapts to your firm’s needs, ensuring optimal resource allocation during peak seasons or year-round support.Seamless Integration

Unison Globus integrates seamlessly with popular tax software like Drake, Quicken, Zoho Books, Xero, and Sage, ensuring smooth workflows and easy collaboration with your in-house team.Long-Term Partnership

Committed to building long-term, growth-focused partnerships, Unison Globus helps your firm scale efficiently while maintaining high standards of quality and client service.Integration with Existing Services

Outsourcing partners can easily integrate with your in-house teams and existing systems, ensuring a smooth workflow. With compatibility across major tax software (e.g., Drake, Quicken, Xero), outsourcing becomes a seamless extension of your firm’s operations.

How Outsourcing Tax Prep to India Can Transform Your CPA Firm!

The Future of Tax Preparation Outsourcing

As the tax preparation landscape evolves, the integration of automation and AI into outsourcing services is expected to grow. This will further streamline the process, reduce errors, and enhance overall efficiency, making outsourcing an even more attractive option for CPA firms.

The future of tax preparation outsourcing is set to be defined by technological advancements, with automation and artificial intelligence (AI) playing pivotal roles in shaping the industry. As the tax landscape continues to evolve, here’s how these innovations will redefine outsourcing for CPA firms:

Automation for Efficiency and Accuracy

Automation is transforming tax preparation by streamlining routine tasks such as data entry, document categorization, and tax form generation. This not only speeds up the process but also significantly reduces the risk of human error, ensuring higher accuracy and faster turnaround times. For CPA firms, this means less time spent on administrative tasks and more focus on value-added services like client advisory and strategic tax planning.AI-Powered Decision Making

AI is enhancing the accuracy of tax preparation by leveraging machine learning to identify patterns, predict tax liabilities, and automatically flag potential compliance issues. These AI-driven insights enable outsourcing partners to deliver a higher level of precision in tax return preparation, minimizing risks related to IRS audits and tax penalties. For firms outsourcing to India, this technology allows them to meet complex tax demands with greater speed and confidence.Improved Client Experience

AI and automation not only benefit tax professionals but also enhance the client experience. With faster processing times and more accurate returns, CPA firms can provide clients with real-time updates and proactive solutions. This, in turn, helps CPA firms differentiate themselves in a competitive market, positioning them as forward-thinking, tech-savvy partners.Scalability and Flexibility

As automation and AI improve the efficiency of tax preparation processes, CPA firms can scale operations effortlessly without proportional increases in overhead costs. Whether it’s ramping up during tax season or managing year-round workloads, the combination of offshore outsourcing and technology ensures your firm remains agile, efficient, and ready for future growth.The Long-Term Outlook: Sustainable Growth

In the long run, AI-driven outsourcing will allow firms to transition from purely transactional work to higher-value strategic services. By leveraging technology, CPA firms can build more sustainable, scalable business models, while also offering enhanced tax advisory and client-facing solutions. Unison Globus, with its deep integration of automation and AI tools, ensures that your outsourcing needs are future-proof, offering long-term value and growth potential.On A Final Note

Outsourcing tax preparation to India offers significant benefits, from cost savings to operational scalability, and can enhance your firm’s ability to serve clients during the busy tax season. By choosing a reliable outsourcing partner like Unison Globus, you can improve your firm’s efficiency and focus on strategic, advisory services that add value to your clients.

Ready to take the next step?

Contact Unison Globus today to explore how our tax outsourcing solutions can help your firm scale efficiently and provide exceptional service to your clients.

Outsourcing tax preparation to India is not just a cost-saving strategy but it’s a transformative approach to boosting your firm’s efficiency, scalability, and ability to deliver exceptional client service. With the right outsourcing partner like Unison Globus, you gain access to a highly skilled team, cutting-edge technology, and flexible solutions that can help you meet peak demands during tax season while freeing up your in-house resources to focus on high-value advisory services.

As the tax landscape continues to evolve, partnering with a trusted outsourcing provider ensures that your firm stays ahead of the curve – enhancing compliance, reducing errors, and increasing capacity without the added overhead.

[gtranslate]

[gtranslate]