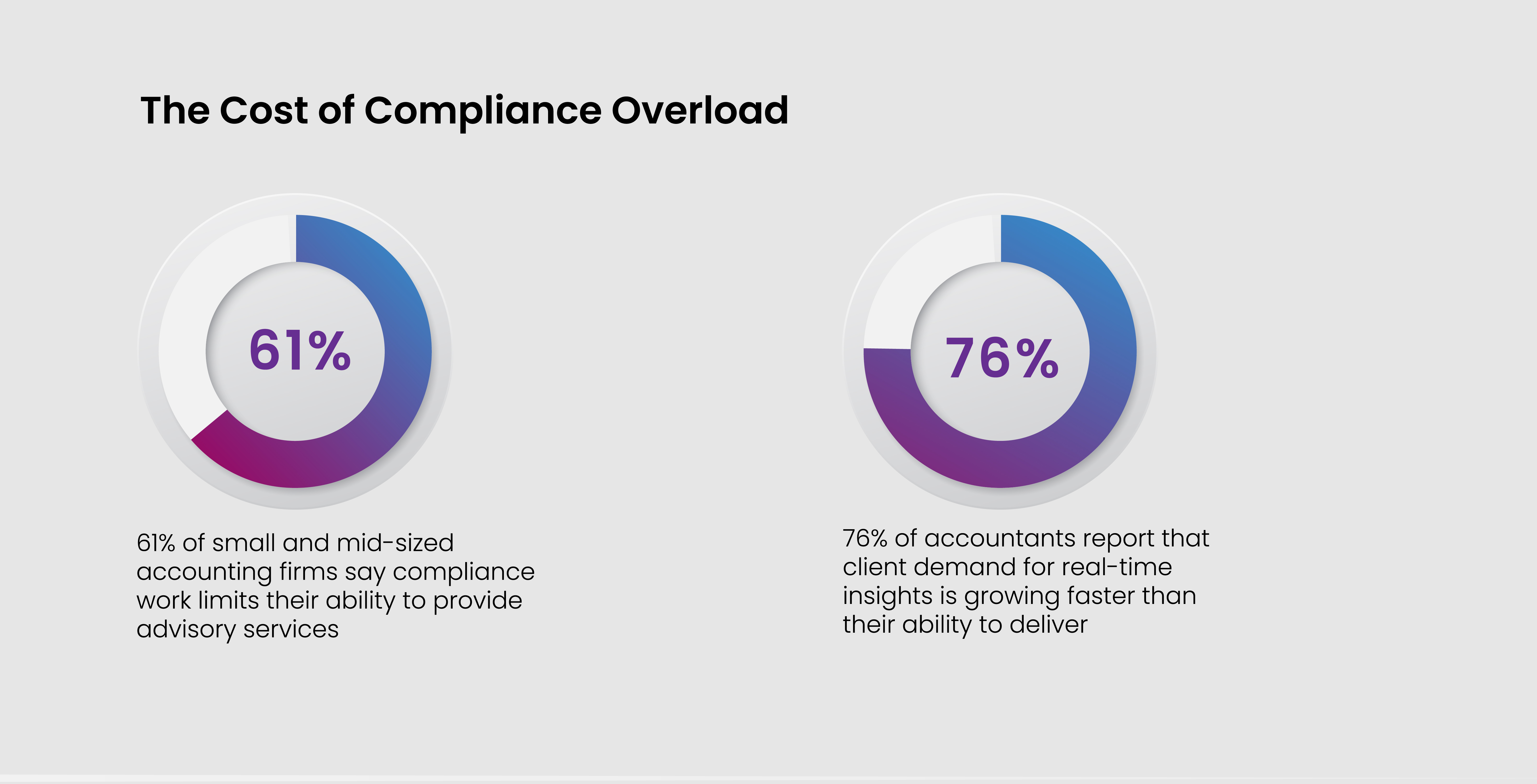

Talk to any high-growth accounting firm today and you will hear a familiar story. Revenue is up. Demand is steady. New opportunities keep arriving. And yet, internally, things feel tighter than ever. Income fluctuates month to month. Client expectations continue to rise. Another intense tax season has stretched resources to the limit. Backlogs never seem to fully disappear. Teams are talented, committed, and visibly exhausted.

This is a classic inflection point. The firm’s commercial success has outpaced the internal structures designed to support it. At this stage, growth is no longer constrained by demand. It is constrained by delivery capacity, workflow design, and how effectively people’s time is used.

For firms looking ahead to 2026 and beyond, the most important strategy is no longer “working harder.” It is redesigning how the firm operates. And this is where Offshore Staffing 2.0 is reshaping what sustainable growth looks like.

Offshore Staffing 2.0: A Strategic Operating Model

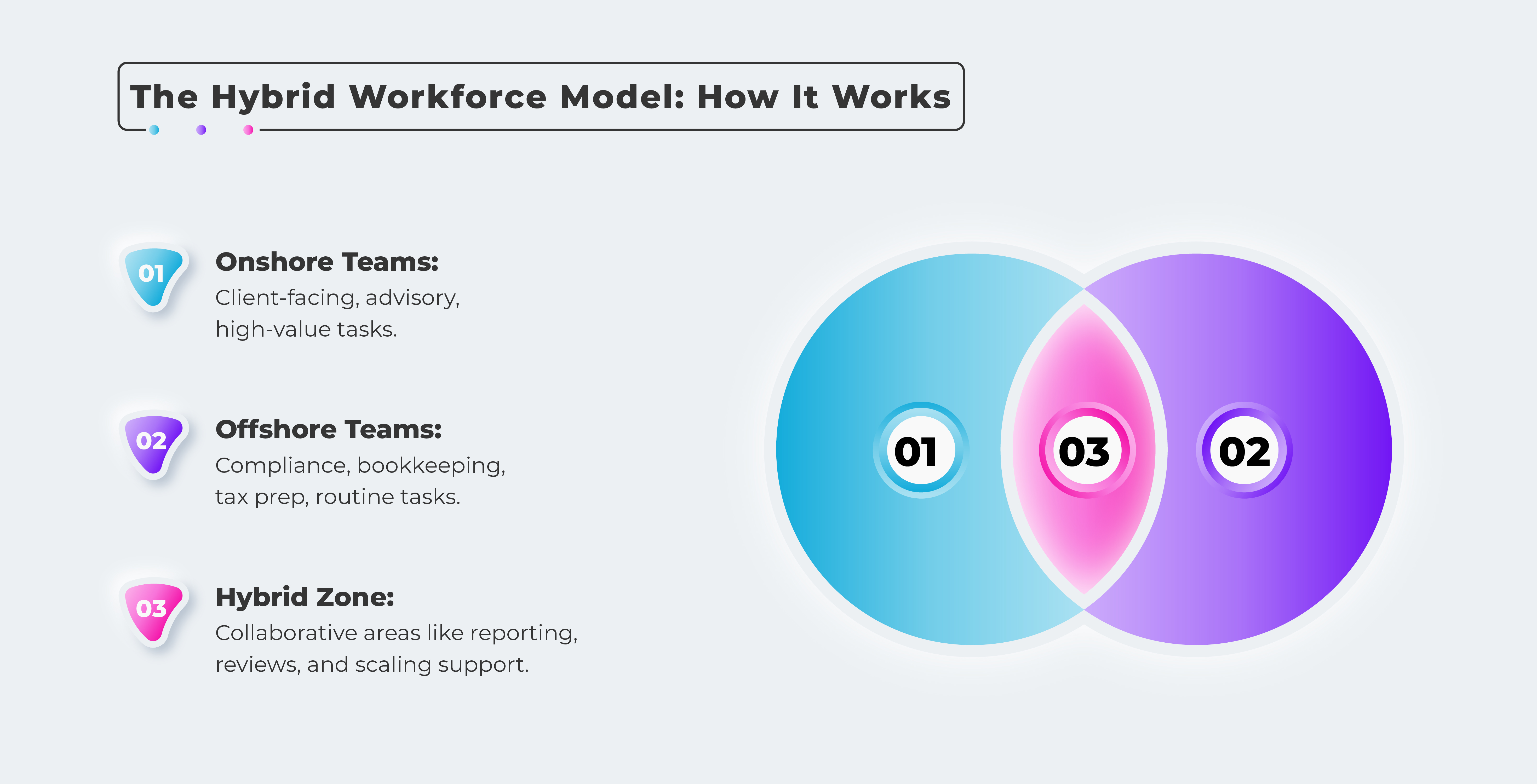

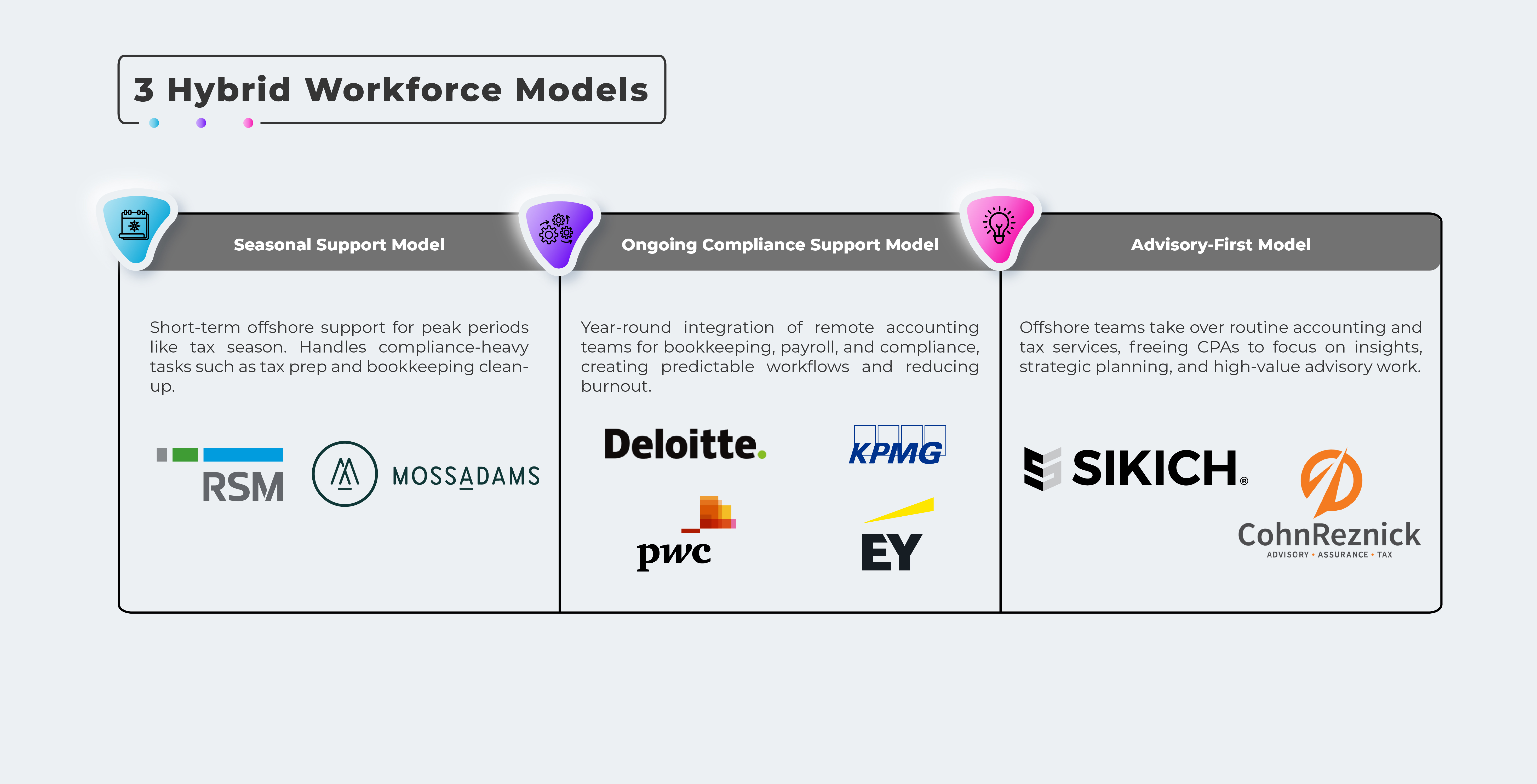

Traditional offshoring was often treated as a short-term fix: overflow work during busy season, or low-cost support for specific tasks. Offshore Staffing 2.0 is fundamentally different.

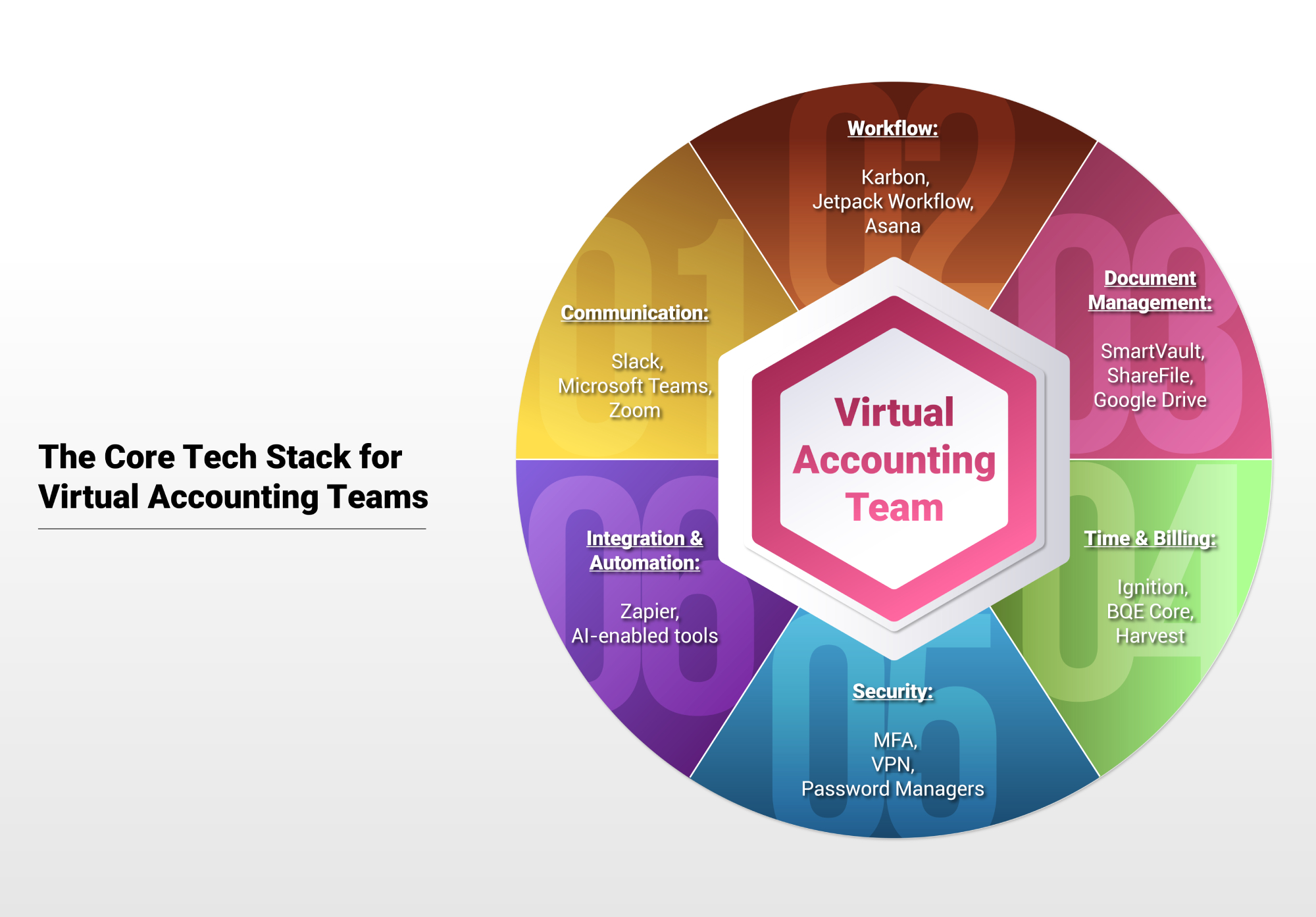

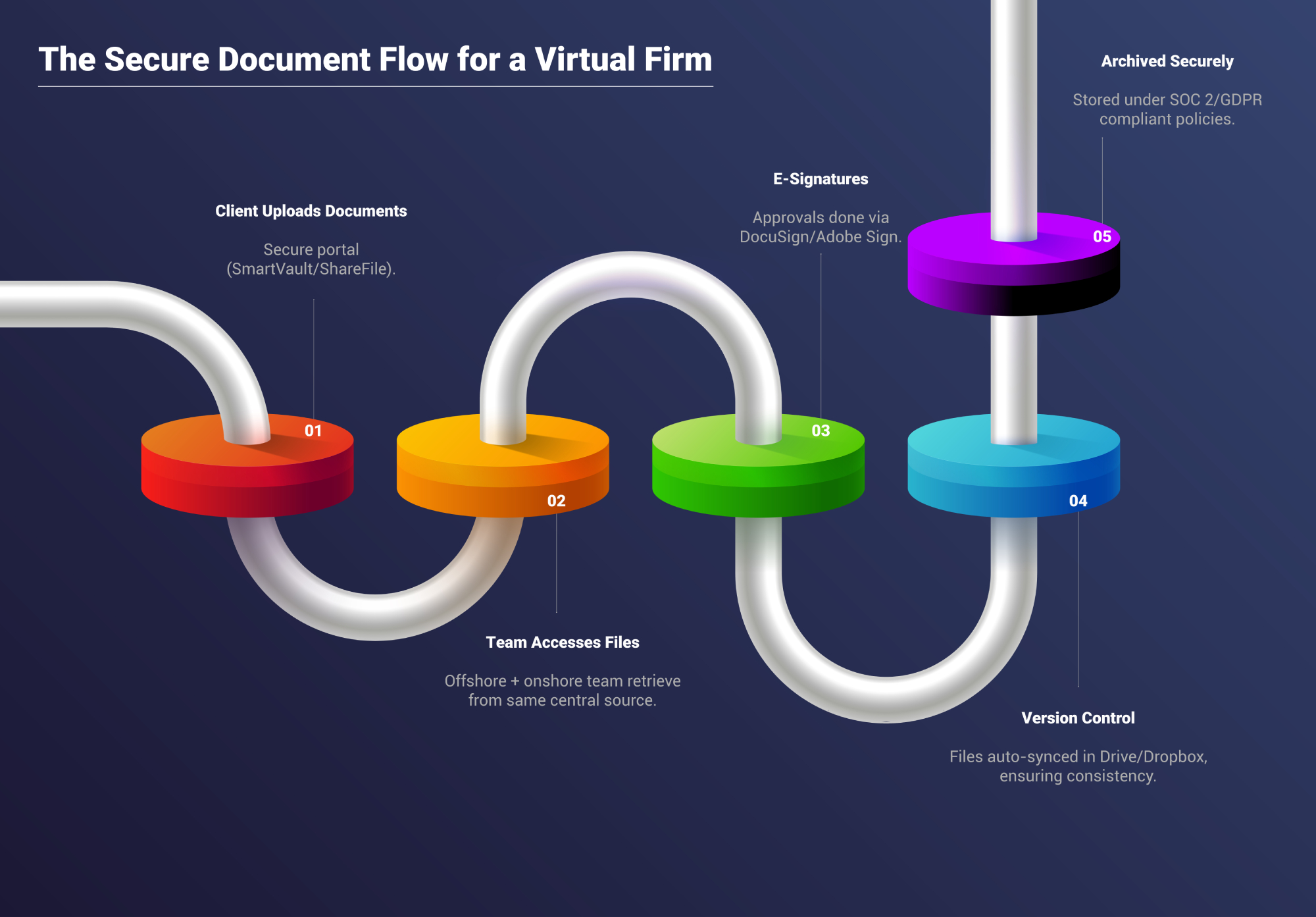

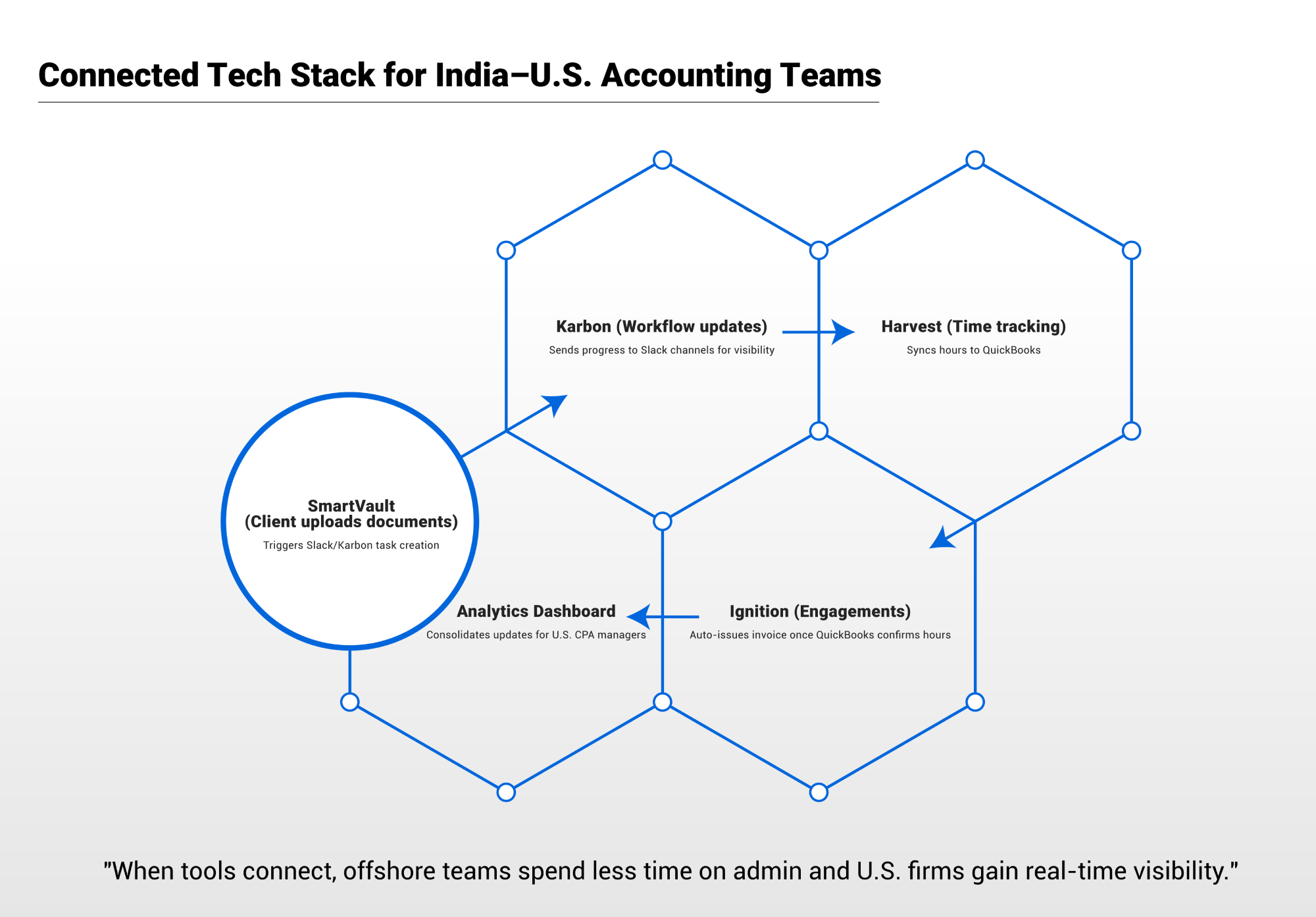

In this model, offshore accountants and professionals are fully integrated into the firm’s operations. They use the same systems, follow the same workflows, and work as part of the same delivery team as their onshore colleagues. They are not “outsourced labour.” They are an extension of the firm.

Firms adopting this approach are not simply trying to reduce costs. They are building stability into their operating model:

- Predictable delivery capacity

- Consistent turnaround times

- Improved quality control

- reduced dependency on seasonal hiring

- More resilient teams

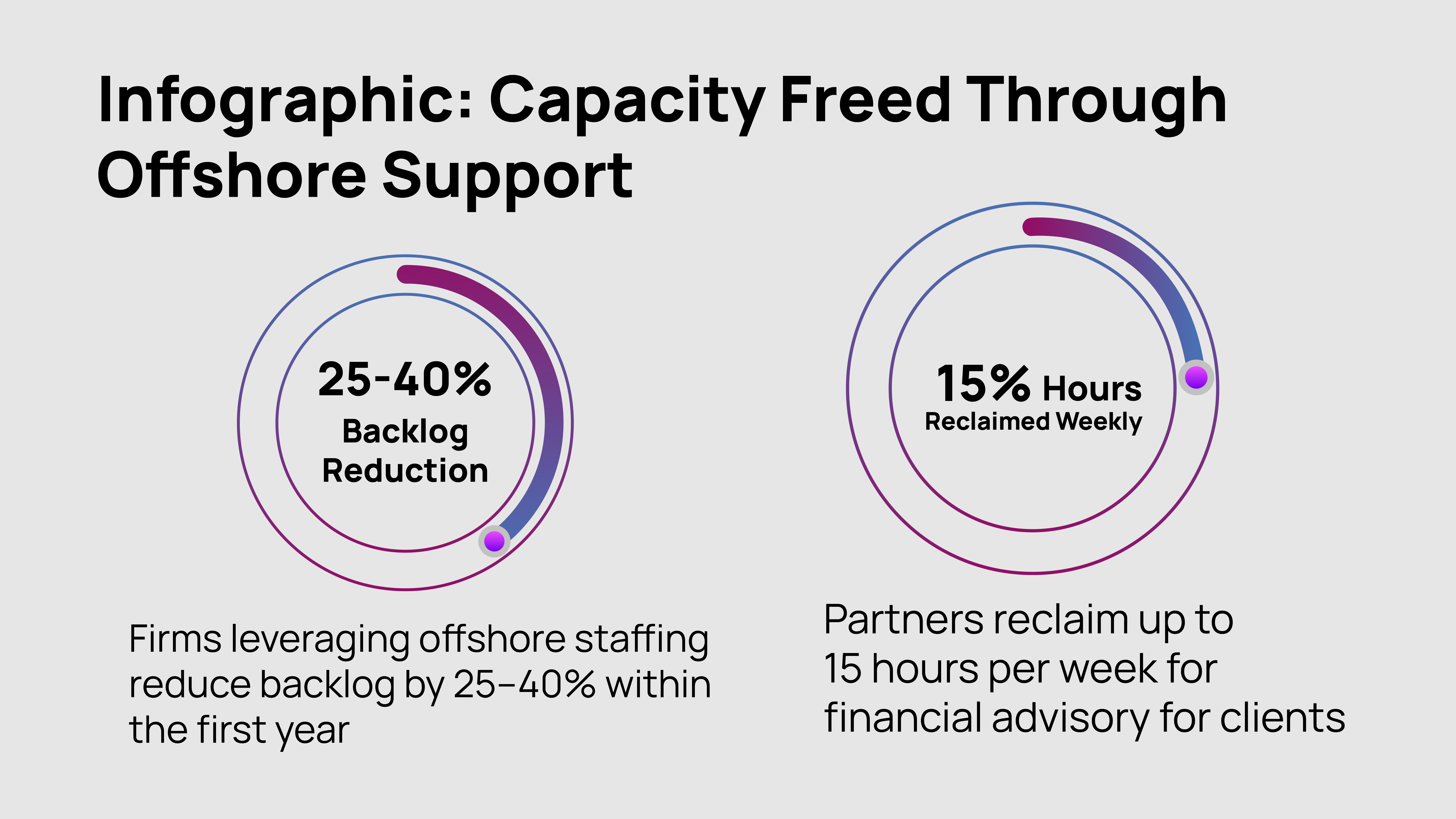

Most importantly, senior onshore staff are no longer trapped in a cycle of constant preparation, review, rework, and deadline chasing. Their time is freed to focus on higher-value activities that directly drive profitability and long-term growth.

Operational Imperatives for Accountants in 2026

Firms that want to strengthen delivery and protect their people in 2026 should focus on three priorities now.

This matters profoundly for CPA firms because Tax Season introduces more logins, more devices, more staff, and more external access points than any other time of year. Zero Trust ensures that even if an attacker steals a password or compromises a device, they cannot freely move inside your systems or reach sensitive client data.

1. Secure Capacity Before the Work Arrives

Every year, many firms make the same decision: “Let’s get through January first. Then we’ll plan.”

And every year, the same regret follows. By the time workload peaks, it is already too late to build meaningful capacity. Recruitment is slow, onboarding takes time, and internal teams absorb the pressure.

Firms that secure year-round offshore capacity remove this risk entirely. They can absorb surges in workload without panic. Turnaround times remain consistent. Client service does not deteriorate under pressure. And staff are protected from the worst effects of seasonal overload. Capacity becomes a strategic asset rather than an annual crisis.

2. Overhaul Workflows

When deadlines are missed or quality drops, it is rarely due to lack of effort. The real causes are usually structural:

- Unclear responsibilities

- Fragmented systems

- Undocumented processes

- Unrealistic assumptions about available capacity

- Fragile handovers between team members

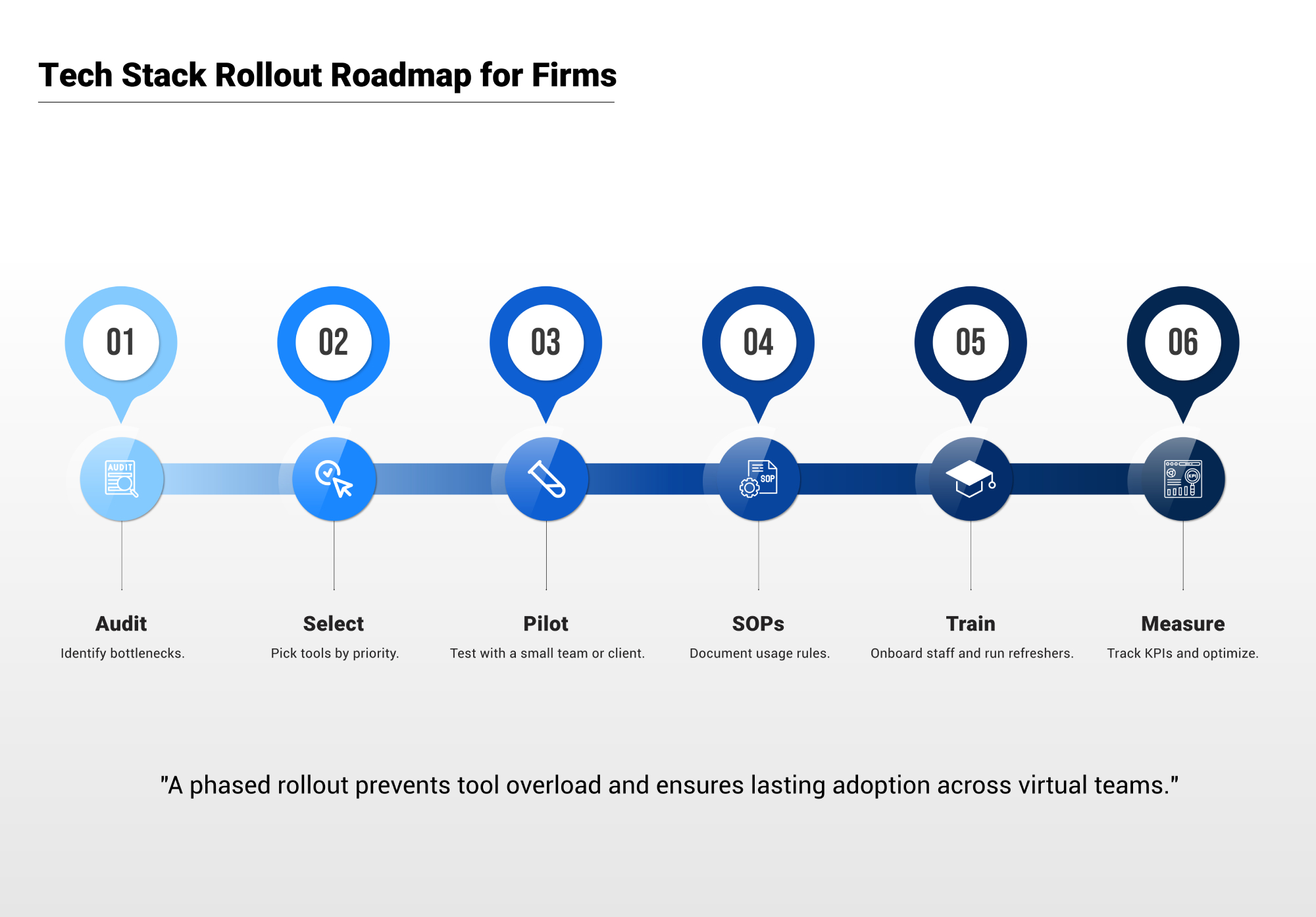

Introducing an integrated offshore team forces firms to confront these weaknesses. Processes must be documented. Roles must be clarified. Workflows must be designed intentionally rather than evolving organically under pressure. This discipline benefits everyone.

3. Allow Onshore Talent to Focus on Growth

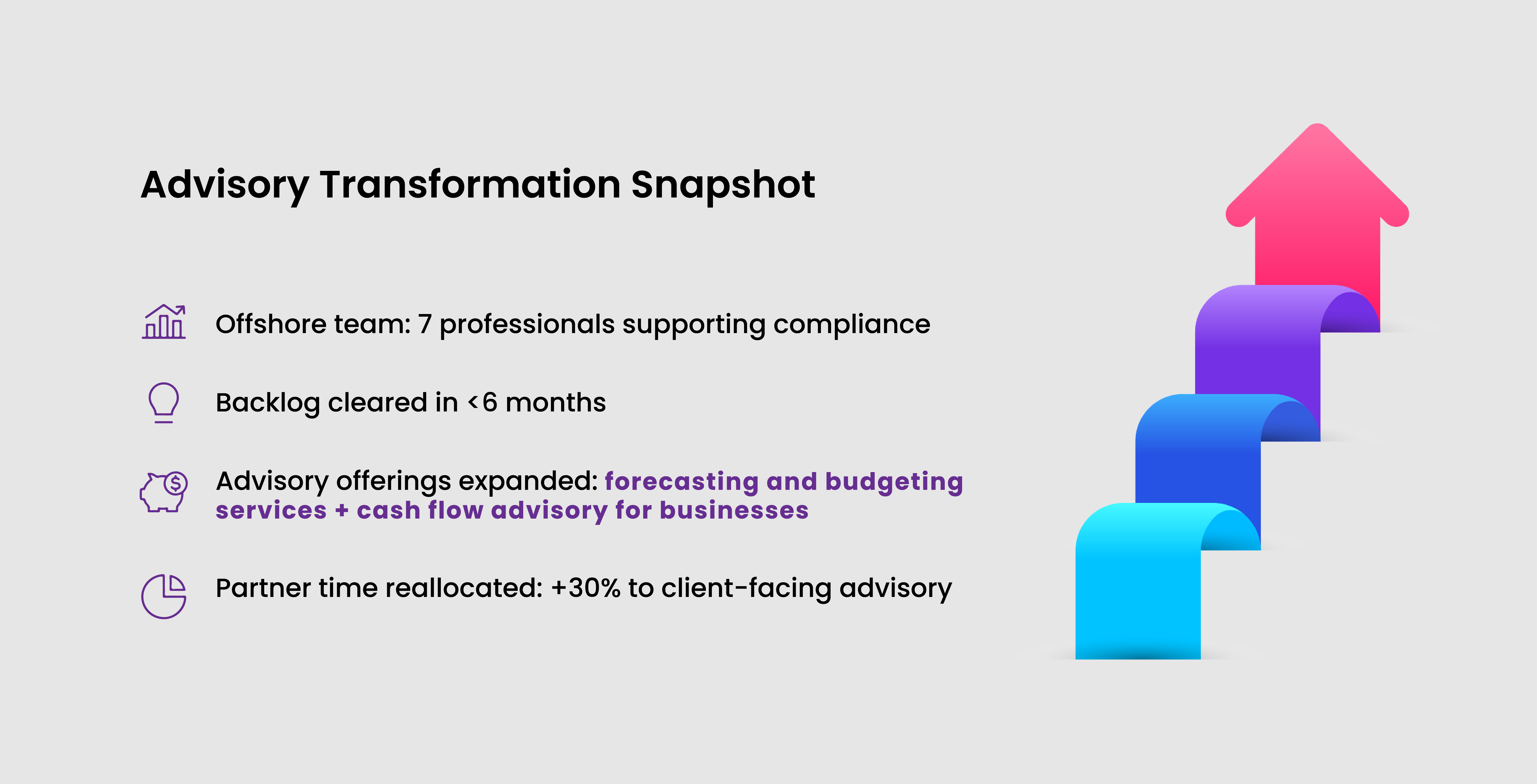

Most firms are sitting on an underused asset: their senior professionals. Highly trained accountants spend enormous amounts of time on work that, while necessary, does not require their level of expertise. When offshore professionals handle resource-intensive tasks, onshore teams can finally focus on advisory services, business planning, forecasting and cash-flow modelling This shift transforms both margins and morale.

Clients receive more value. Partners spend time growing the firm instead of firefighting. And talented professionals see a clearer long-term career path that does not revolve around perpetual overload.

Looking Forward

The firms that thrive in 2026 will not be the ones that simply push harder. They will be the ones that redesign their operations. They will build capacity before it is urgently needed. They will invest in workflows that scale. And they will structure their teams so that expertise is applied where it creates the greatest value.

Offshore Staffing 2.0 is not a shortcut. It is a modern operating model designed for firms that take growth seriously. It creates stability in revenue delivery, consistency in client experience, and sustainability for the people doing the work.

A Smarter Way to Build the Modern Accounting Firm

At Unison Globus, we work with forward-thinking accounting firms to design and implement fully integrated offshore teams that strengthen delivery, protect onshore talent, and unlock sustainable growth. Our focus is not volume or low-cost outsourcing. It is building long-term operating capacity that aligns with your firm’s systems, culture, and strategic goals.

For firms entering the next phase of growth, the question is no longer whether to change how work is delivered, but how well it will be designed. If your firm is ready to move beyond short-term fixes and build a scalable operating model for 2026 and beyond, Unison Globus offers the experience, structure, and depth required to do it properly.

[gtranslate]

[gtranslate]