- Protects client trust through secure systems

- Streamlines workflows for compliance-heavy tasks

- Gives leaders visibility to manage both onshore and offshore staff confidently

Communication & Collaboration: Staying Aligned Across Time Zones

Daily Interaction & Team Syncs

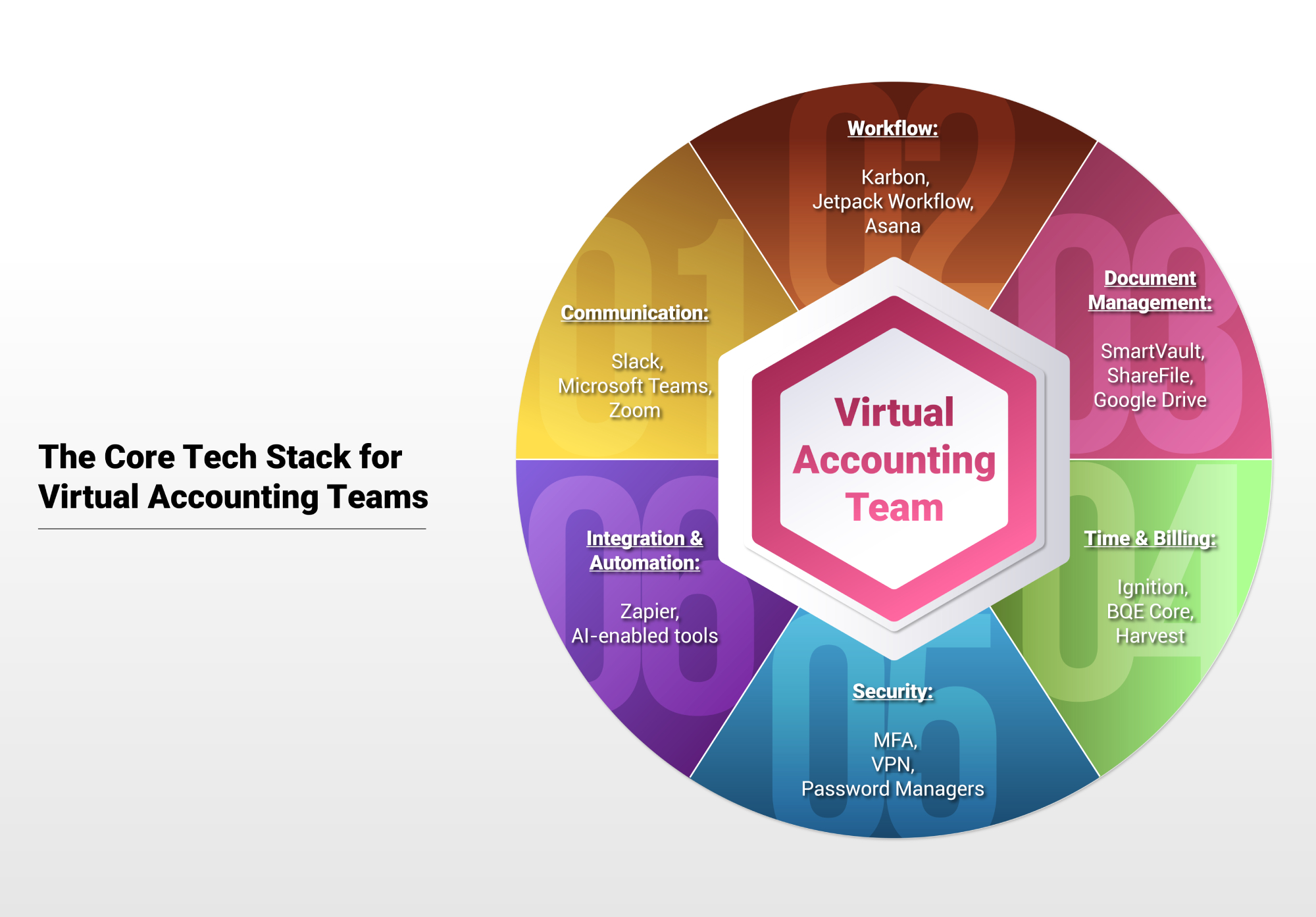

- Slack – Channel-based messaging keeps conversations organized by client, department, or project. This prevents scattered updates and allows managers to quickly scan priorities.

- Microsoft Teams – Combines chat, file sharing, and meetings in one hub. Especially useful for firms already integrated with Microsoft 365.

Video Conferencing & Client Calls

- Zoom – Reliable for large meetings and external calls with clients. Easy screen sharing makes it ideal for advisory reviews and client presentations.

- Microsoft Teams (Meetings) – Allows firms to consolidate both internal and client-facing meetings in the same platform, reducing app fatigue.

Knowledge Sharing & SOPs

- Notion or Confluence – Perfect for maintaining digital playbooks: year-end tax season procedures, onboarding checklists, or recurring payroll processes. Offshore and onshore staff alike can follow the same documented steps, reducing confusion during peak cycles.

Real Example:

How a Florida CPA Firm Streamlined Communication

The result?

- Email volume dropped by 40% within two months. Managers reported a 25% faster turnaround on tax return reviews because updates were visible in real time.

- Clients noticed improved responsiveness, with one remarking that “we finally feel like your team is one seamless unit.”

Workflow & Project Management: Keeping Deadlines Visible

General Workflow Tools

- Asana – Flexible task lists and boards for organizing projects. Great for firms that want a customizable tool with plenty of integrations.

- Trello – Simple, visual Kanban boards make it easy to assign and track tasks. Perfect for smaller firms or specific projects like a year-end close.

- Monday.com – Highly visual dashboards, automation features, and cross-team visibility. Especially useful for multi-service firms handling both tax and advisory projects.

Accounting-Specific Practice Management

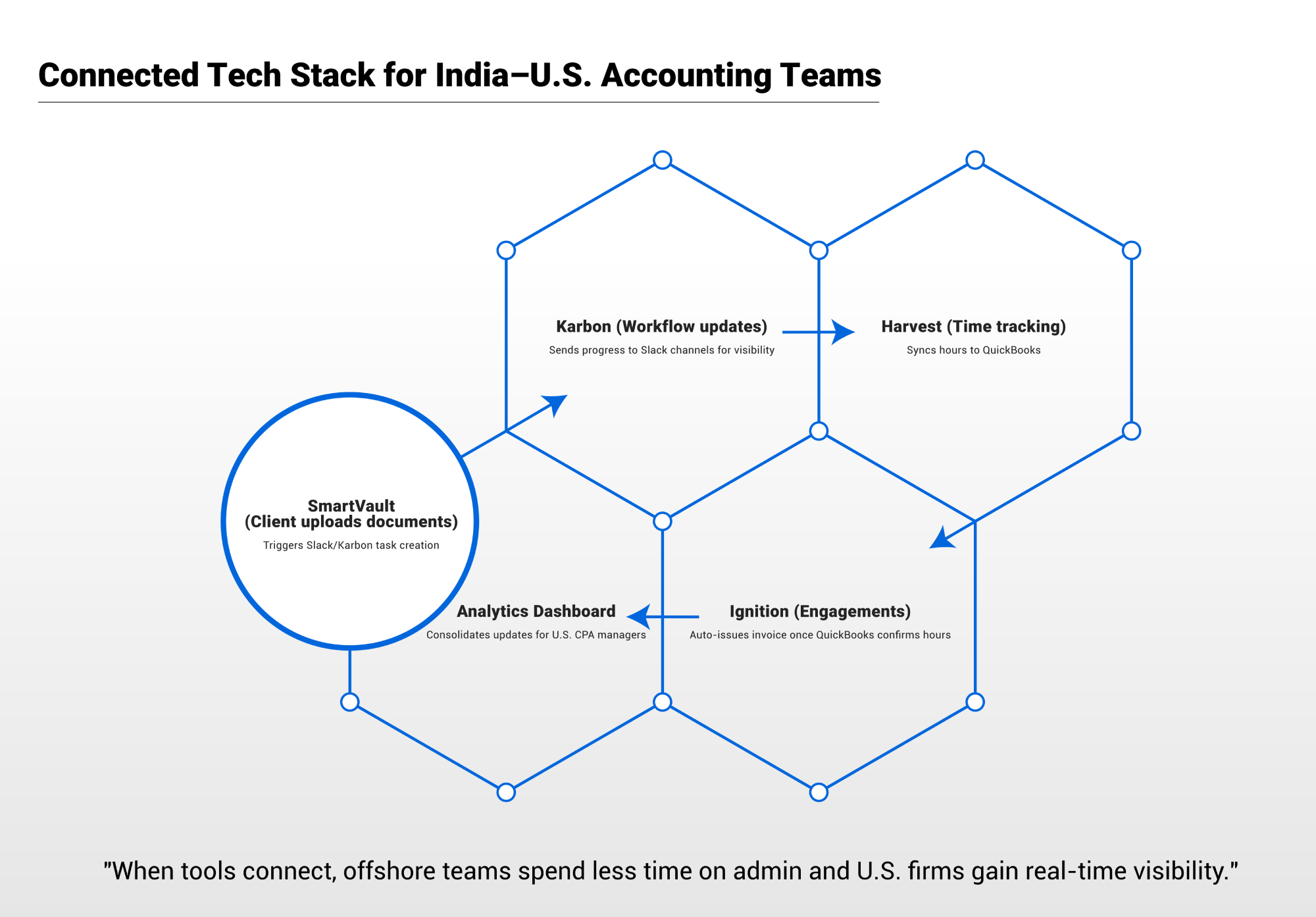

- Karbon – Built for accounting firms, with recurring tasks, integrated email, and visibility into client timelines.

- Jetpack Workflow – Streamlined task automation for compliance-heavy firms. Includes templates for recurring jobs like monthly bookkeeping or quarterly payroll.

- TaxDome – All-in-one platform combining CRM, secure portals, e-signatures, and workflow automation.

Transparency for Managers

The biggest advantage? Real-time visibility. Onshore managers can see what offshore staff are working on at any moment, reducing the need for constant check-ins. This not only improves efficiency but also builds trust in distributed teams.Practice Management Software Comparison

| Tool | Best For | Key Features | Ideal Firm Size |

|---|---|---|---|

| Karbon | Workflow visibility + team comms | Auto-recurring tasks, integrated email, client timelines | Mid-to-large CPA firms |

| Jetpack Workflow | Compliance-focused task automation | Templates for recurring jobs, deadline tracking, simple reporting | Small-to-mid firms |

| TaxDome | All-in-one client management | CRM, secure portal, e-signatures, workflow automation | Solo to mid-size |

| Asana | General project management | Kanban boards, task lists, integrations with Slack/Drive | Small-to-large, multi-service firms |

| Trello | Visual simplicity | Drag-and-drop Kanban boards, lightweight task management | Small firms or pilot use |

Real Example:

A UK Firm Brings Order to Tax Deadlines

A UK-based accounting practice handling 250+ small business clients was struggling to keep up with quarterly VAT filings. Deadlines were tracked in spreadsheets, and managers often had to chase staff for updates.

After adopting Karbon, the firm automated recurring VAT tasks with pre-set deadlines. Offshore staff in South Africa updated progress directly in the platform, and managers had a live dashboard showing which returns were complete, pending review, or at risk.

The impact was immediate:

- Missed deadlines dropped to zero within the first quarter.

- Managers reported saving 8–10 hours per week previously spent on chasing updates.

- The firm’s client satisfaction scores rose, with several clients praising their “proactive reminders” (actually automated via Karbon).

Document & Data Management: Secure, Centralized, Accessible

Core Tools for Document Management

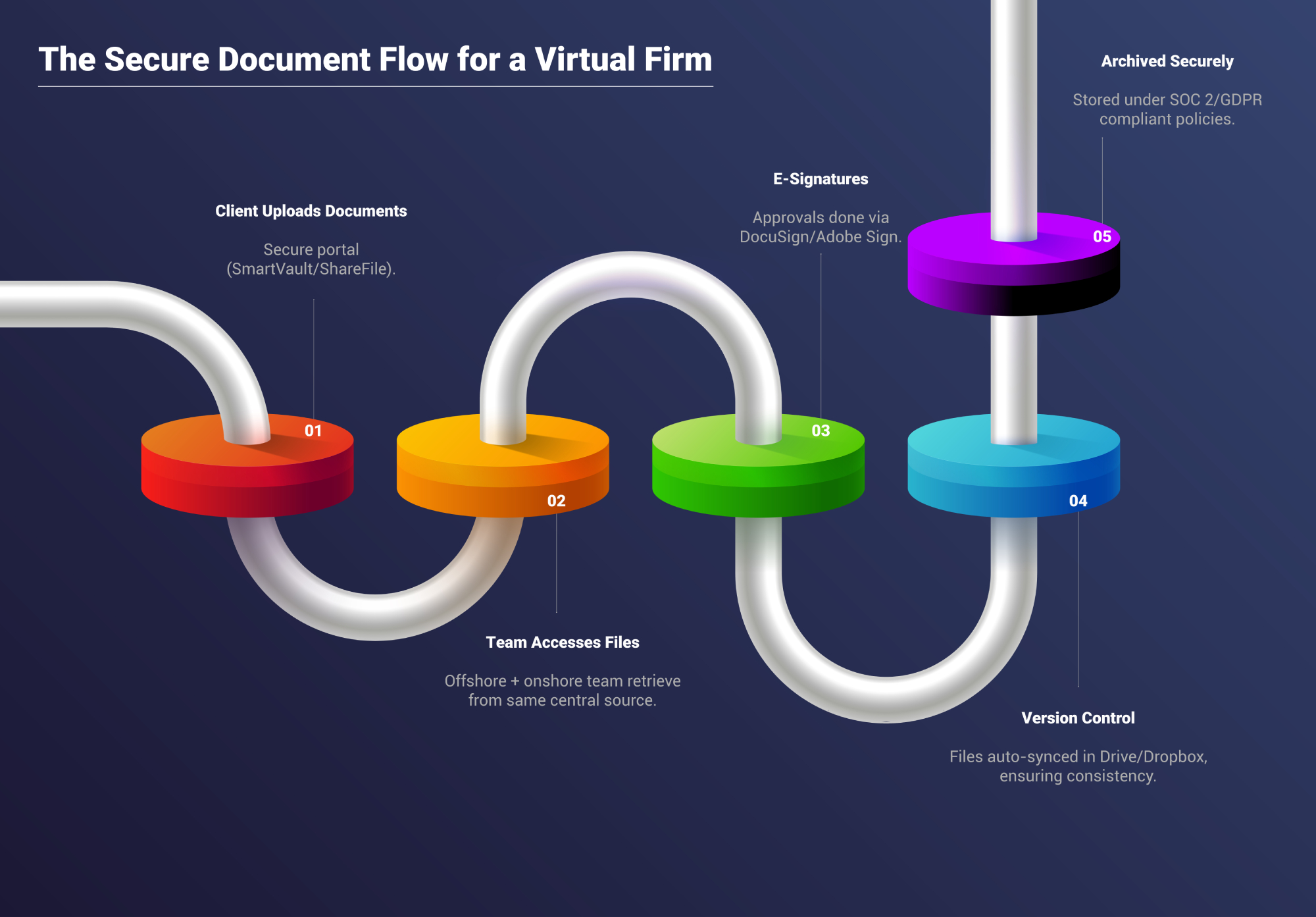

- Secure Client Portals – ShareFile, SmartVault, OneDrive Business provide encrypted file sharing and SOC 2/GDPR compliance. Clients can upload documents directly into the portal, eliminating unsecured email exchanges.

- E-Signatures – DocuSign and Adobe Sign make engagement letters, tax filings, and approvals seamless. Instead of waiting weeks for signed PDFs, firms can finalize client agreements in hours.

- Version Control – Google Drive and Dropbox Business ensure teams always work on the latest version of a file, avoiding costly errors when multiple people collaborate.

Real Example:

Secure Portals Boost Client Confidence

Results:

- Email attachments reduced by 70% during tax season.

- Staff saved an estimated 150+ hours of manual file handling.

- Client confidence increased, reflected in higher satisfaction ratings.

Time & Billing Tools: Keeping the Practice Profitable

Time Tracking

- Harvest – Tracks billable hours against U.S. clients, integrates with project tools like Asana and Slack, and generates clear reports.

- TimeCamp – Provides detailed timesheets and productivity insights, helpful when teams handle multiple CPA clients at once.

- Clockify – A lean, cost-effective solution that smaller Indian firms often use when they’re just getting started with structured time tracking.

Billing & Engagement Software

- Ignition (formerly Practice Ignition) – Widely adopted in the U.S.; Indian outsourcing partners can align billing to U.S. client engagement cycles. Once an engagement is signed, invoices and recurring payments trigger automatically.

- QuickBooks Online – Popular with U.S. CPA firms, making it an easy billing tool for Indian partners to integrate. Offshore hours can sync directly into client accounts for faster reconciliation.

- BQE Core – Combines time tracking, billing, and profitability dashboards, best suited for firms offering higher-value advisory alongside compliance.

Explore how Unison Globus Offshore Staffing 2.0 can help your U.S. accounting firm build a tech-enabled offshore team in India.

We combine top-tier talent with best-in-class technology setups to ensure your firm stays compliant, efficient, and client-focused.

Contact us today to learn how we can help you streamline your offshore workflows and scale with confidence.

Get in touch now

Real Example:

Ahmedabad Outsourcing Firm Serving U.S. CPAs

Impact:

- Revenue leakage dropped by 18%

- Payment cycles shortened from 45 days to 20 days.

- U.S. partners praised the improved transparency: they could clearly see how offshore hours tied back to deliverables.

Security & Compliance: Protecting Client Trust

Core Security Tools & Practices

- Multi-Factor Authentication (MFA) and Password Managers Tools like 1Password or LastPass ensure that even if a password is compromised, accounts stay protected.

- VPNs and Endpoint Protection Offshore staff in India connect securely to U.S. systems through firm-controlled networks, ensuring no unencrypted access.

- Regulatory Compliance Outsourcing firms should align with SOC 2, ISO 27001, and IRS guidelines (Publication 4557). These frameworks guarantee data handling that meets U.S. expectations.

- Access Controls Limit staff access to only the files and applications required for their work to reduce risk exposure.

Real Example:

Pune Outsourcing Firm Aligns with U.S. Standards

Impact

- Client confidence improved, with several U.S. partners highlighting security as a reason for expanding their outsourcing scope.

- No compliance incidents reported in three years.

- Offshore staff workflows became faster since secure portals eliminated delays caused by encrypted email attachments.

Real Example:

Pune Outsourcing Firm Aligns with U.S. Standards

Impact

- Client confidence improved, with several U.S. partners highlighting security as a reason for expanding their outsourcing scope.

- No compliance incidents reported in three years.

- Offshore staff workflows became faster since secure portals eliminated delays caused by encrypted email attachments.

Integration & Automation: Making Tools Work Together

Key Integration & Automation Tools

- Zapier and Make (Integromat) Automate repetitive workflows by connecting apps such as QuickBooks, Karbon, and Slack. For example, when a client uploads a document to SmartVault, Zapier can notify the assigned accountant in Slack automatically.

- Native Integrations Many accounting-focused tools now sync out of the box. Karbon integrates with Microsoft Teams, TaxDome integrates with QuickBooks, and Ignition links directly to Xero and QuickBooks for billing.

- AI-Enabled Automation OCR tools automatically extract data from receipts and bank statements, reducing manual data entry. Machine learning features in modern platforms also suggest recurring tasks or flag anomalies.

Real Example:

Bengaluru Outsourcing Firm Automates U.S. Workflows

Impact

- Manual updates reduced by 60%.

- Invoice turnaround dropped from two weeks to three days.

- U.S. partners saw faster progress visibility without chasing offshore teams.

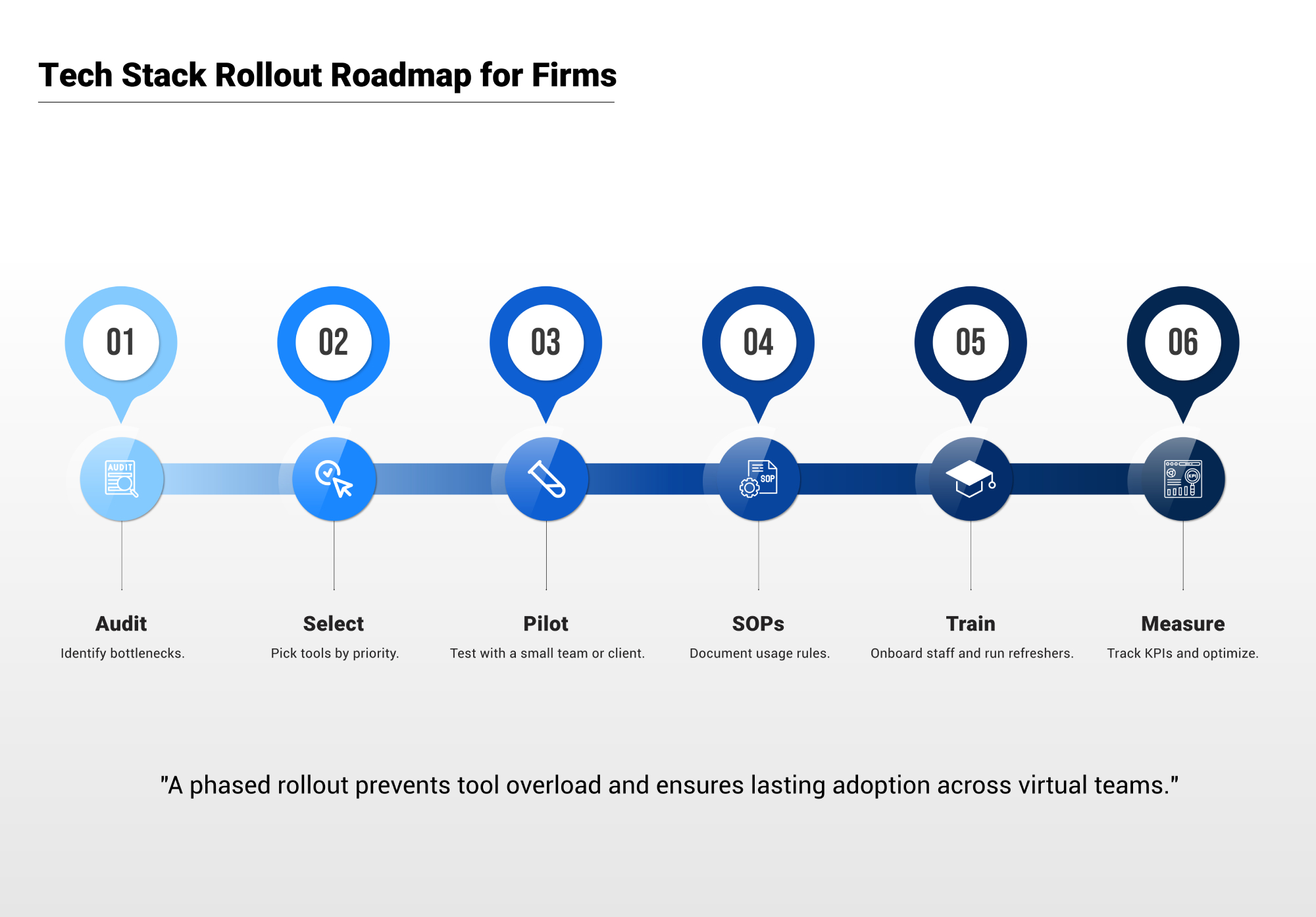

Implementation Roadmap: Rolling Out a Tech Stack Without Chaos

Steps for a Smooth Rollout

- Audit Current Pain Points

-

- Identify bottlenecks such as missed deadlines, scattered files, or delayed client communication.

- Involve both onshore managers and offshore staff to get a complete view.

-

- Select Tools by Priority

-

- Choose one tool for each core need (communication, workflow, documents, billing, security).

- Avoid tool overload by focusing on integrations.

-

- Start Small with a Pilot

-

- Test the tool with one client account or one internal team.

- Collect feedback before expanding firmwide.

-

- Build Standard Operating Procedures (SOPs)

-

- Document how each tool should be used.

- Examples: “All client documents must be uploaded to SmartVault” or “All recurring bookkeeping tasks go into Karbon.”

-

- Train Consistently

-

- Run onboarding sessions for new tools.

- Schedule refresher sessions during peak periods such as year-end closes or tax season.

-

- Measure Adoption and Outcomes

-

- Track KPIs such as deadline compliance, client satisfaction, invoice turnaround, or staff utilization.

- Adjust based on results to avoid tool fatigue.

-

Real Example:

Mumbai Firm’s Phased Rollout

Impact

- Within six months, 100% of offshore staff were actively using all tools.

- U.S. clients reported smoother handoffs and fewer deadline issues.

- Managers had a single dashboard for visibility across engagements.

[gtranslate]

[gtranslate]