Accounting has always been one of the major business operations of any organization. Financial statements about income and expenditure are vital for making informed business decisions. To optimize the business operation and make it more efficient, the key strategies are often based on accounting automation and outsourcing.

While outsourcing accounting services to an external firm, often experienced entrepreneurs can make mistakes. Here are some common mistakes that a business owner or CFO should avoid-

1. Not defining your outsourcing goals

The most common mistake that businesses often make is not clearly defining their business needs and how to plan to benefit from outsourcing accounting. You should clarify whether your outsourcing goal is to save costs, access specialized services, or save effort on time-consuming accounting functions such as bookkeeping. In case you do not have a clear plan and go about outsourcing accounting to get lower rates, you might not get the desired results.

You should decide whether to outsource a single accounting service or outsource the whole accounting function to a firm, such as bookkeeping services. For example, outsourcing a single process can help you to get expert service at lower costs instead of hiring in-house talent. On the other hand, outsourcing the accounting process completely can help your in-house team to focus on their core functions. The type of accounting outsourcing services you avail will depend on what you are trying to gain from the outsourcing company.

2. Let the Company Know What You Need

If you are new to outsourcing, many companies can push you to opt for outsourcing services that you may not need. This is quite a common outsourcing mistake. But you need to have a good understanding of what is most suitable for your business. A company with good credentials should be able to understand your requirements and create an accounting solution that satisfies your outsourcing needs.

And though they may suggest solutions that can help you address issues that have something to do with outsourcing, you do not need to get into an arrangement that is not suitable for you. This includes using accounting software you are not familiar with, exceeding your budget for outsourcing, or signing up for anything that does not add value to your business.

3. Not Assessing the Outsourcing Company Carefully

As a business owner, you would not want to share your confidential financial data with a company just based on online reviews. Even if a LinkedIn profile of an accounting firm looks impressive, you must screen the company via a formal interview. One wise way is to start a written interview via email. Find out whether it is a CPA firm or a specialized outsourced bookkeeping service provider. Once you are convinced that the company can meet your accounting needs, opt for a telephone conversation.

Here are some things that you should try to find out at this stage-

- How many outsourced accountants do they have within their team and how many will be serving your company?

- The company’s policies, processes, and contingency plan must handle employee attrition.

- Their industry experience and if they understand the nuances of your domain.

- The type of technology or cloud accounting software the firm will use to support your finance department.

- How do they ensure the accuracy of financial statements?

- Finally, arrange for a video interview or visit the outsourcing company to understand their work culture, employees, and the systems and processes.

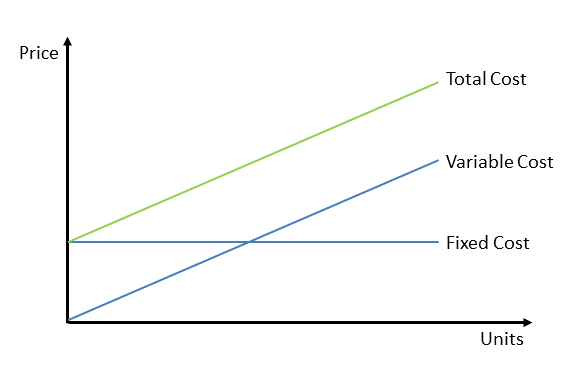

4. Opting for the lowest-cost solutions

One of the common objectives is to outsource any big or small business to save money. But it may not necessarily guarantee that you will get good service by paying less. In fact, considering cost as the only hiring criteria or hiring an accounting freelancer to save money can be one of the major outsourcing mistakes.

Want to know why?

For instance, when you opt for the services of an accounting freelancer rather than a professional accounting services provider, the person might be trained to handle only a specific part of the accounting work. So, the service quality will be below par, and your financial reports will get delayed. In the same way, an outsourcing company that advertises too low prices might charge some extra money later in the form of extra fees and hidden costs.

You may also face problems like inaccuracies in financial data such as cash flow errors, non-compliance and regulatory concerns, and lack of transparency & communication. So, rather than opting for a cheap accounting and bookkeeping services provider, search for a reliable firm with a certified CPA. Go for a firm that offers multiple, customized accounting services, even if it means you need to spend slightly more.

5. Outsourcing the Most Challenging Task

If you own a small business, you might intend to outsource the most challenging tasks to the outsourced accounting firm. However, it is not always the wise thing to do. Outsourcing your most challenging tasks without prior testing will bring the whole accounting process of your organization to a standstill.

Rather, start the outsourcing process with more standardized, time-consuming accounting functions. By doing so, you can optimize generic functions before outsourcing the complex tasks.

6. Unclear Outsourcing Goals

The most common error that business owners often make is that they fail to define the exact needs of their company and how outsourced accounting can help. You should have clarity about your goal. Is it to gain access to specialized services, save costs, or save time on labor-intensive accounting tasks such as bookkeeping? Opt for an accounting firm to handle a whole accounting function, like payroll and bookkeeping, or just a single service, like accounts and receivables. For instance, you can get a professional service at a cheaper cost by outsourcing a single procedure rather than paying more to hire the same talent in-house.

7. Submissive Authority

You may be accounting firms that coax you to opt for services you do not need, especially if you are new to outsourcing. A business owner knows what is best for his business. You may want to opt for an outsourcing firm that understands your requirements by creating a solution for outsourcing goals. And if they offer accounting solutions that focus their concerns, if you find software that is not beneficial for your firm, it is wise to look for another firm.

8. Requirements Are Not Properly Communicated

It would be wise to communicate your expectations properly before finalizing the deal. Get them legalized through a written agreement. You can include the following-

- Number of hours

- Mode and frequency of communication

- Frequency of reconciling accounting books

- Approach to problems related to accounting services

- Number of hours

Conclusion

Outsourcing enables you to focus on the vital aspects of your business operations and be free from the stress of managing the finances all on your own. By opting for accounting and finance outsourcing to an accomplished firm, you will quickly gain access to the right resources, processes, and technological infrastructure. Your back-office operations will work more smoothly, ensuring your clients get a satisfactory experience.